Stocks

Don’t Miss This Next Major Megatrend Amid the Chaos

Hello, Reader.

Current market conditions are as difficult as any we have faced during the last 50 years.

We all hate it. We’re all tired of the seemingly never-ending big drops. And we’re all ready to get back to making money.

Here’s the good news: We don’t have to wait for this misery to end.

I think it will continue at least a little while longer. I told my team the other day that we may not be at the beginning the end quite yet, but we may well be at the end of the beginning.

So yes, stocks may fall more. Inflation will remain on the rise. And we will start to wonder how much more we must endure.

Amid the chaos, remember this: Bear markets sow the seeds of future investment successes.

If you own great companies that are growing and operating in big trends, I advise you to stay patient. The market always recovers, and good stocks recover further and faster. If you bail out now, you may well sell at the bottom. Trust me, there’s nothing worse.

You can also be proactive while you’re being patient… and even make money when it seems like everything is falling.

Yes, some stocks are moving higher right now. Invest in the right ones with tailwinds to keeping the moving higher and you can find yourself ahead of the game.

Like stocks in the next major megatrend…

Sometimes the Answer is Right In Front of Us

If there is one indisputable conclusion we can draw from the market’s action this year, it’s that technology stocks are getting hammered while energy stocks power higher.

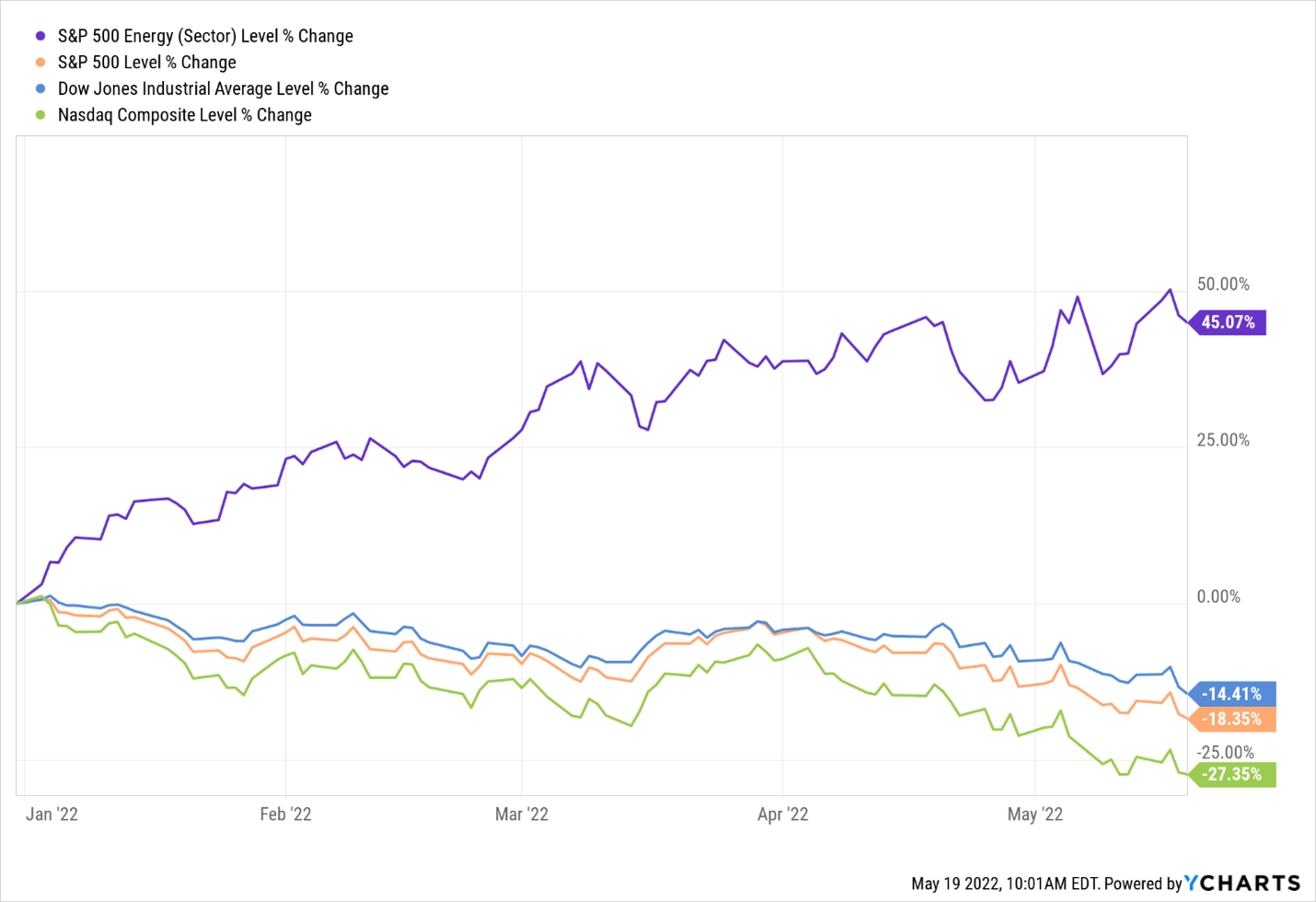

Here’s the proof…

The S&P 500 Energy Sector (purple line) is crushing all three major indexes this year. You could be up 45% in energy or down anywhere from 14% to 27% in the major indexes.

Get the oil companies to pay YOU for once!

While the S&P 500 teeters on the brink of a bear market, big energy companies like Exxon Mobil Corp. (XOM) and Chevron Corp. (CVX) made new highs this week.

It must be too late to get in now, right?

I sure don’t think so. This is no accident. Nor is at a fluky result of crazy trading.

In the December issue of Investment Report, I told my readers a tightening oil market coupled with rising inflation provided ample reason to add an oil stock (which we did). I reiterated in January that these tailwinds meant oil stocks would likely deliver market-beating results in 2022.

To be honest, I didn’t expect this much outperformance this soon, but that was before Russia’s invasion of Ukraine.

I continue to expect oil stocks to outperform because of supply and demand, the two most basic forces moving any market.

Goldman Sachs’s head of commodities, Jeff Curie, recently stated on Bloomberg TV…

I’ve been doing this for 30 years, and I’ve never seen markets like this. This is a molecule crisis. We’re out of everything, I don’t care if it’s oil, gas, coal, copper, aluminum… you name it, we’re out of it.

Corroborating that assessment, Saudi minister Prince Abdulaziz bin Salman warned of decreasing spare capacity across the entire global energy sector…

I am a dinosaur, but I have never seen these things. The world needs to wake up to an existing reality. The world is running out of energy capacity at all levels. We’ve been warning about the lack of investment. That lack of investment is catching up with a lot of countries.

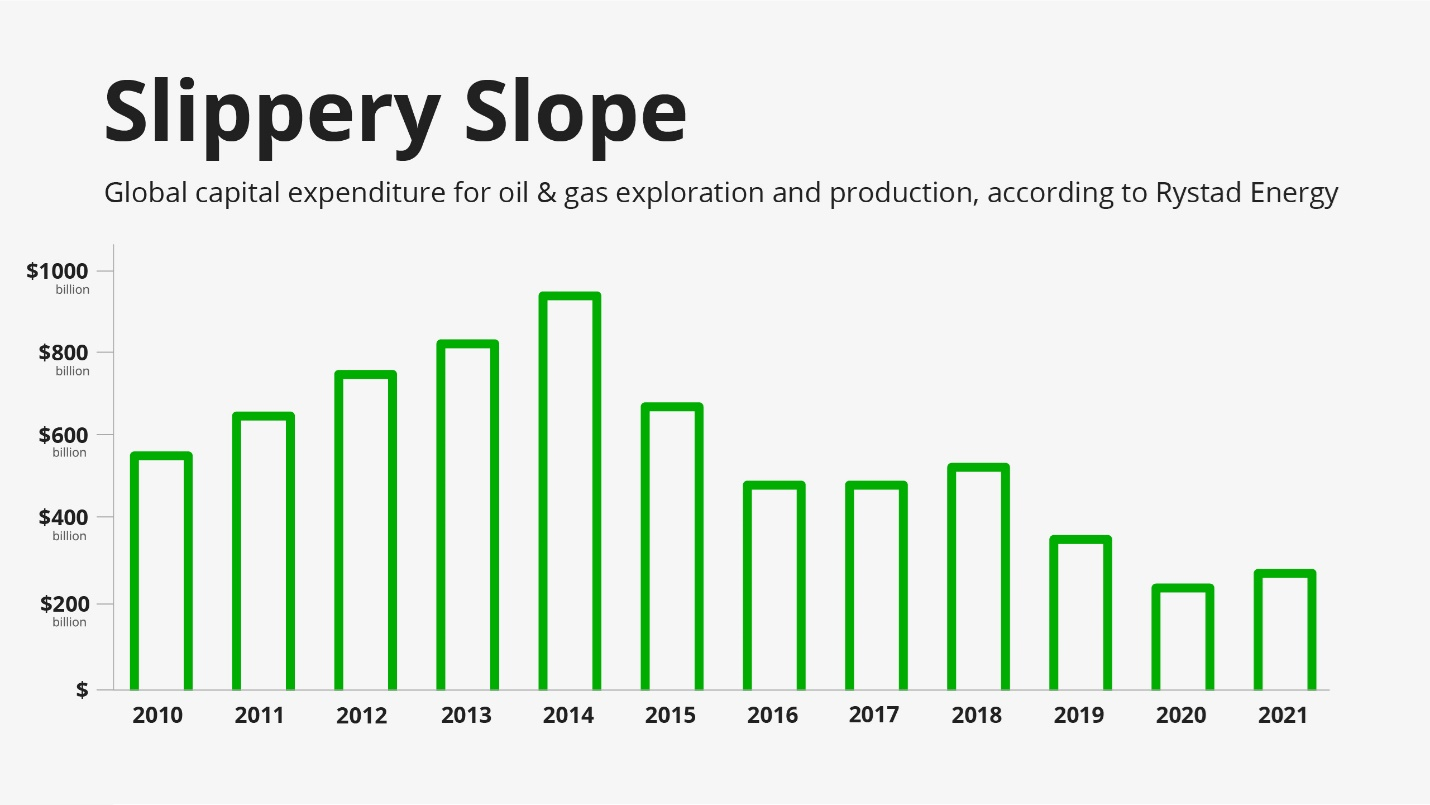

According to Rystad Energy, global investments in oil and gas exploration and production have plummeted by about 65% since the 2014 peak.

This prolonged underinvestment has reduced global crude production capacity, which is a big part of the reason why oil and gas prices have been heading hitting multi-year highs.

Will you be kicking yourself a year from now because you missed out?

The intensifying supply crunch is also a big part of the reason why I started adding energy-focused stocks in my Investment Report portfolio at the end of 2021, and we have picked up the pace here in 2022.

We’re probably not done yet either, as I am actively researching additional plays in the sector. (Click here to learn how to be a part of Investment Report before my next recommendation drops.)

As a group, the stocks we added are nicely in the green and trouncing the market.

Over the coming months, I expect even better results. In fact, I expect these stocks to deliver sizeable, market-beating gains… no matter what the overall market does.

$100 oil is not a fluke or a fleeting blip. It is a powerful megatrend that could propel oil-related stocks to surprisingly large gains, made all the sweeter because of the carnage going on around them.

Sincerely,

Eric

P.S. A bear market is no fun – the understatement of the year. But at times like these, it’s understandable to want more guidance than what a newsletter can offer. With my Investment Report research service, you’ll gain access to myriad special reports, insightful monthly issues, and at least one trade recommendation per month. Details on how to join here.

The post Donât Miss This Next Major Megatrend Amid the Chaos appeared first on InvestorPlace.

Hello, Reader.

Current market conditions are as difficult as any we have faced during the last 50 years.

We all hate it. We’re all tired of the seemingly never-ending big drops. And we’re all ready to get back to making money.

Here’s the good news: We don’t have to wait for this misery to end.

I think it will continue at least a little while longer. I told my team the other day that we may not be at the beginning the end quite yet, but we may well be at the end of the beginning.

So yes, stocks may fall more. Inflation will remain on the rise. And we will start to wonder how much more we must endure.

Amid the chaos, remember this: Bear markets sow the seeds of future investment successes.

If you own great companies that are growing and operating in big trends, I advise you to stay patient. The market always recovers, and good stocks recover further and faster. If you bail out now, you may well sell at the bottom. Trust me, there’s nothing worse.

You can also be proactive while you’re being patient… and even make money when it seems like everything is falling.

Yes, some stocks are moving higher right now. Invest in the right ones with tailwinds to keeping the moving higher and you can find yourself ahead of the game.

Like stocks in the next major megatrend…

Sometimes the Answer is Right In Front of Us

If there is one indisputable conclusion we can draw from the market’s action this year, it’s that technology stocks are getting hammered while energy stocks power higher.

Here’s the proof…

The S&P 500 Energy Sector (purple line) is crushing all three major indexes this year. You could be up 45% in energy or down anywhere from 14% to 27% in the major indexes.

Get the oil companies to pay YOU for once!

While the S&P 500 teeters on the brink of a bear market, big energy companies like Exxon Mobil Corp. (XOM) and Chevron Corp. (CVX) made new highs this week.

It must be too late to get in now, right?

I sure don’t think so. This is no accident. Nor is at a fluky result of crazy trading.

In the December issue of Investment Report, I told my readers a tightening oil market coupled with rising inflation provided ample reason to add an oil stock (which we did). I reiterated in January that these tailwinds meant oil stocks would likely deliver market-beating results in 2022.

To be honest, I didn’t expect this much outperformance this soon, but that was before Russia’s invasion of Ukraine.

I continue to expect oil stocks to outperform because of supply and demand, the two most basic forces moving any market.

Goldman Sachs’s head of commodities, Jeff Curie, recently stated on Bloomberg TV…

I’ve been doing this for 30 years, and I’ve never seen markets like this. This is a molecule crisis. We’re out of everything, I don’t care if it’s oil, gas, coal, copper, aluminum… you name it, we’re out of it.

Corroborating that assessment, Saudi minister Prince Abdulaziz bin Salman warned of decreasing spare capacity across the entire global energy sector…

I am a dinosaur, but I have never seen these things. The world needs to wake up to an existing reality. The world is running out of energy capacity at all levels. We’ve been warning about the lack of investment. That lack of investment is catching up with a lot of countries.

According to Rystad Energy, global investments in oil and gas exploration and production have plummeted by about 65% since the 2014 peak.

This prolonged underinvestment has reduced global crude production capacity, which is a big part of the reason why oil and gas prices have been heading hitting multi-year highs.

Will you be kicking yourself a year from now because you missed out?

The intensifying supply crunch is also a big part of the reason why I started adding energy-focused stocks in my Investment Report portfolio at the end of 2021, and we have picked up the pace here in 2022.

We’re probably not done yet either, as I am actively researching additional plays in the sector. (Click here to learn how to be a part of Investment Report before my next recommendation drops.)

As a group, the stocks we added are nicely in the green and trouncing the market.

Over the coming months, I expect even better results. In fact, I expect these stocks to deliver sizeable, market-beating gains… no matter what the overall market does.

$100 oil is not a fluke or a fleeting blip. It is a powerful megatrend that could propel oil-related stocks to surprisingly large gains, made all the sweeter because of the carnage going on around them.

Sincerely,

Eric

P.S. A bear market is no fun – the understatement of the year. But at times like these, it’s understandable to want more guidance than what a newsletter can offer. With my Investment Report research service, you’ll gain access to myriad special reports, insightful monthly issues, and at least one trade recommendation per month. Details on how to join here.

The post Don’t Miss This Next Major Megatrend Amid the Chaos appeared first on InvestorPlace.