Stocks

What’s Behind Bitcoin’s Rally?

Luke Lango explains why Bitcoin has surged in the wake of banking weakness … gold nearly sets a new all-time-high before pulling back … what the Discount Window is telling us

From “down 15%” to “up 18%.”

That’s what Bitcoin has done over the past two-and-a-half weeks as a slew of headlines have rocked the financial markets.

What’s behind the reversal?

First, two major players in the Bitcoin world, Silvergate and Silicon Valley Bank, crashed, leading to Bitcoin sinking. Fears about crypto liquidity drying up resulted in a swift selloff.

Bitcoin fell nearly 15% from its early-March high as crypto investors ran for cover.

But as the backstops kicked in (not for Silvergate), investors raced back to the market. Bitcoin has soared nearly 40% over the last 11 days, netting out to gain of more than 18% since early in the month.

Here’s how the rollercoaster looks…

Now, some Bitcoin bulls believe these gains reflect investors embracing Bitcoin as “digital gold.” In other words, when there’s chaos in financial markets, Bitcoin offers shelter in the storm outside of the traditional banking system.

This might strike you as odd. After all, isn’t Bitcoin a risk-on asset? Isn’t it more closely correlated with riskier technology stocks?

Many investors do hold this belief. However, there’s another seemingly-conflicting view of Bitcoin as an alternative to the dollar and the traditional U.S. banking system. That would make it a risk-off asset for these other investors who want to get away from trouble with the dollar and the banking sector.

Our crypto expert Luke Lango believes some of this risk-off sentiment might be responsible for Bitcoin’s recent surge, but he thinks something else is at play.

How banking failures can goose the crypto sector

Let’s jump to Luke’s weekend update from Ultimate Crypto:

…This rally is mostly about the banking sector meltdown killing prospects for inflation and rate hikes and, by extension, improving prospects for cryptos and risk assets.

Hot inflation and rising interest rates have crushed risk-asset appetite over the past 12 months.

Our bull thesis has long been that in 2023, inflation and interest rates would stop going up and cryptos would start going up.

This is already playing out as we expected.

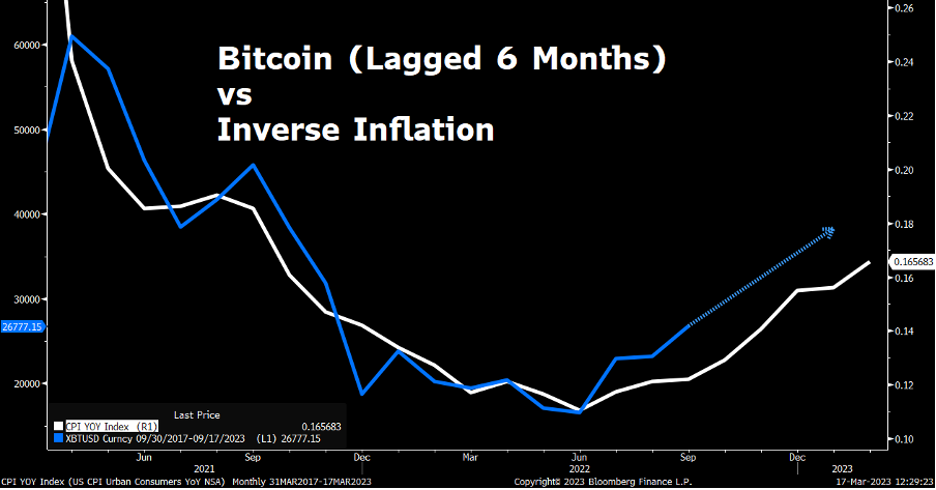

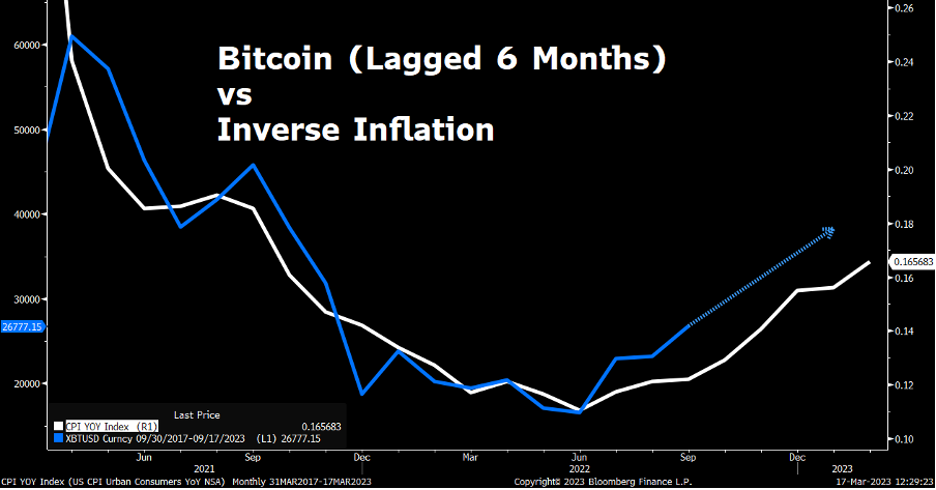

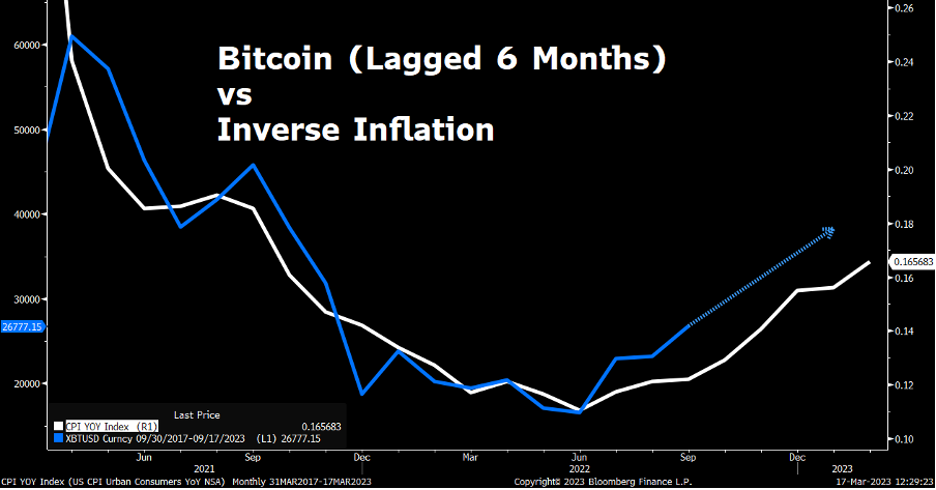

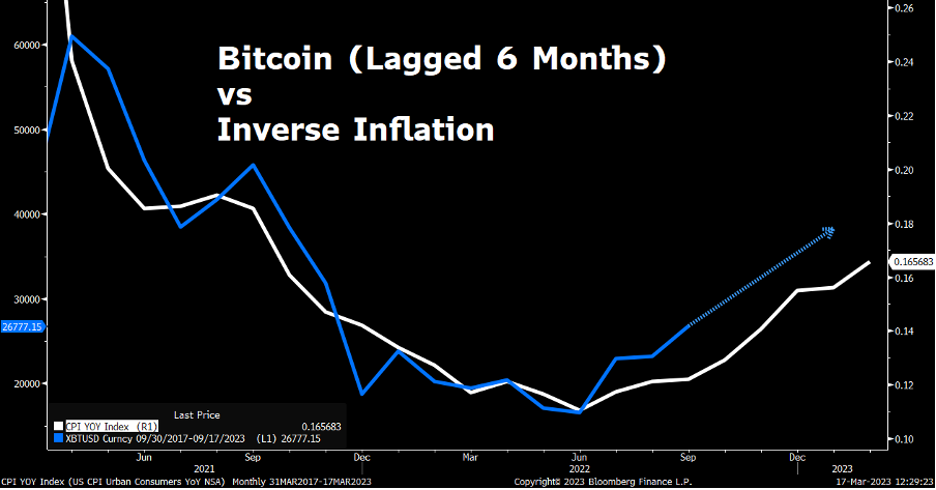

Just look at the following chart. It graphs the inverse of CPI (in white) alongside BTC (in blue), with BTC lagged by six months. Falling inflation is driving crypto prices higher, and this party looks like it is just getting started.

How does the banking sector meltdown impact these trends?

Positively.

Luke points out that a banking failure is hugely deflationary.

As a bank rolls over, other banks tighten their lending standards. Credit dries up immediately, investment in new business slams on the brakes, and consumer spending slows.

Now, multiply that by what’s happened recently, which is not just one bank failure, but a string of them.

Put it all together, and Luke sees inflation crashing in our near future.

Here he is reconnecting these macro events with crypto:

…As inflation crashes and financial contagion fears spread, the Fed will be forced to stop its rate-hiking campaign.

The consensus belief is that it will hike rates 25 basis points next week before pausing in May. We think this is exactly what will happen.

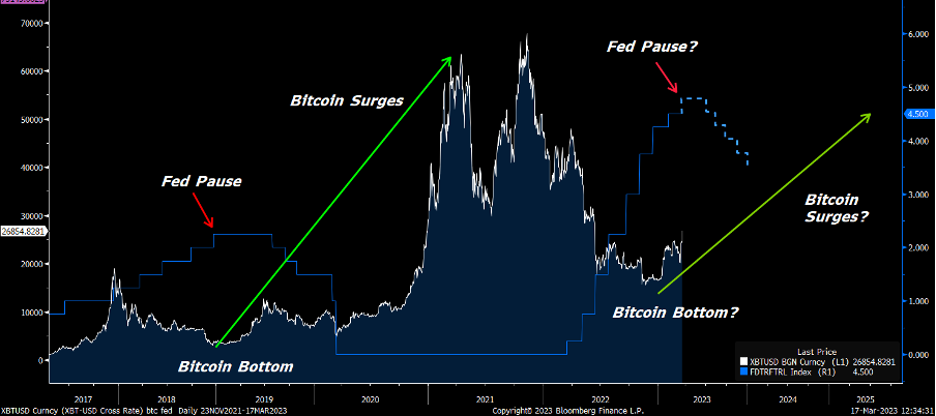

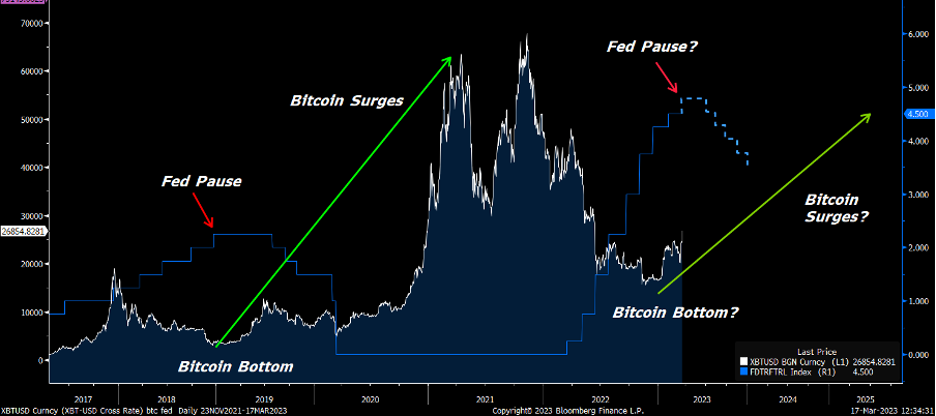

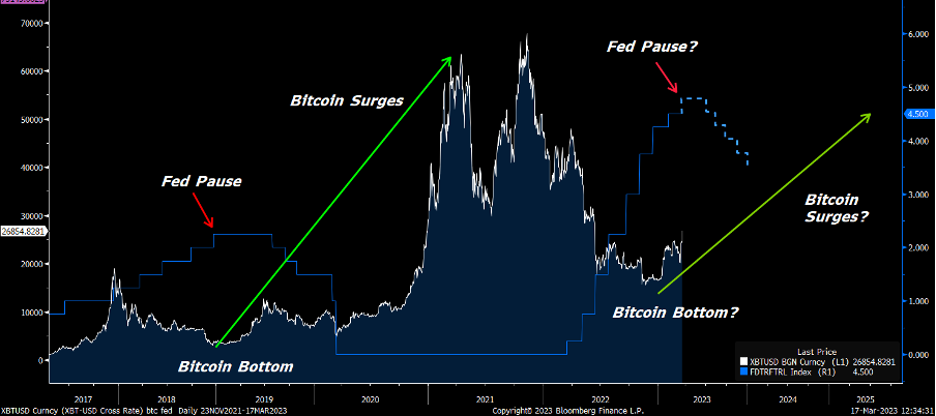

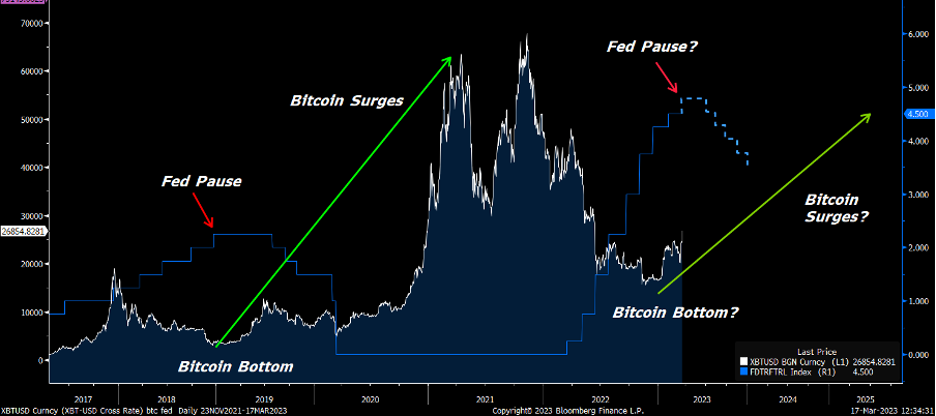

If things do play out this way, that will be very bullish for cryptos, as illustrated by the chart below.

We remain as confident as ever in our call for a crypto boom cycle in 2023.

Meanwhile, there’s another asset that’s loving the banking sector meltdown

Gold (or should we now call it “analog Bitcoin”?)

Yesterday, gold pushed as high as roughly $2,029. That took it within about 2% of its all-time high of about $2,075. It has since pulled back to 1,967 as I write Tuesday morning.

Now, on one hand, this is crazy.

Even after crashing, the 10-year Treasury bond yields 3.56% as I write. Even better, the two-year Treasury yields 4.13%. And you can find FDIC-insured high-yield savings accounts yielding nearly 5%.

Why would investors put their money into gold, that yields nothing?

Fear.

Though Luke just wrote “this party looks like it is just getting started,” which would support risk-on assets, at least for now, there are plenty of scared investors out there who want safety.

And as we noted in last week’s Digest, gold plays the role of “chaos hedge” in a portfolio.

If we look at the banking sector today, even though the recent fires have been put out, there’s still smoke on the horizon.

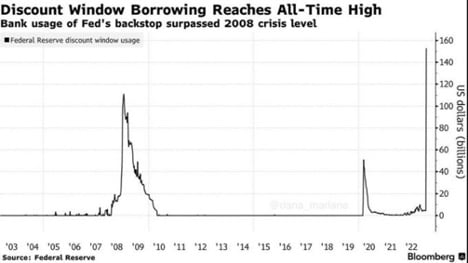

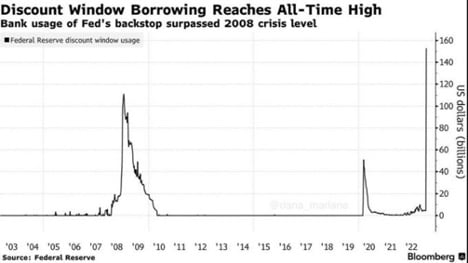

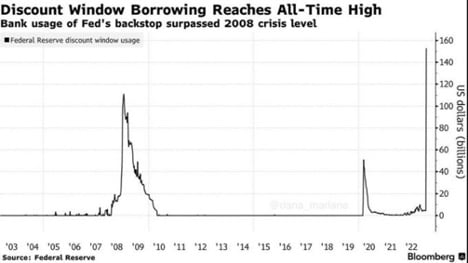

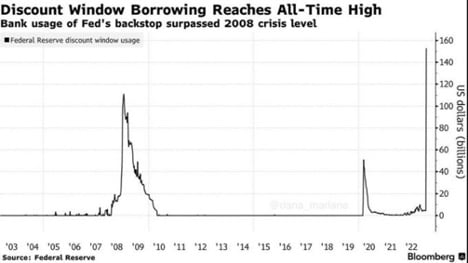

In yesterday’s Digest, we showed you this chart of the Fed’s Discount Window

We’ll explain the details of it in a moment. First, just look at the spike back in the 2008/2009 financial market chaos.

Then, notice that our current spike on the far-right side of the chart is even higher.

So, what is this Discount Window, and what is it telling us?

The Discount Window is the Federal Reserve’s primary facility for supporting the U.S. banking system with added liquidity.

The need for added liquidity arises when market chaos and/or operational weakness causes a bank cash shortfall.

Although the Fed wants to support troubled banks, it doesn’t want to be left on the hook if it lends money to a bank that can’t repay the loan. So, historically, the Fed has required these banks to pony up collateral that has a greater value than the loan itself.

This serves two goals: 1) it protects the Fed, 2) it makes borrowing from the Discount Window less attractive to banks. This makes the Discount Window a “break in case of emergency” lending facility.

With this context, let’s go to Bloomberg to better understand the spike we’re seeing today:

To avert further bank runs, a full-blown financial crisis and potential recession, the Fed decided to make it even easier for banks to borrow from the discount window.

It began valuing the collateral it is offered in return for money “at par,” meaning at its face value, rather than follow the usual practice of imposing a haircut. That decision was partly taken to ease the stigma banks often feel exists when forced to borrow from the Fed.

The central bank wanted to make borrowing from it an easier decision to take in the interest of insulating the wider financial system and economy.

It also put the handling of discount window loans in line with a new emergency loan facility it had created.

Bloomberg details this new facility, called The Bank Term Funding Program, which came to be just weeks ago in the wake of the Silicon Valley Bank (SVB) collapse.

That alone should raise an eyebrow. If the SVB problem was just a one-off, or contained, why would we need a brand-new lending facility beyond the Discount Window?

Back to Bloomberg:

Taken together, the credit extended through the two backstops reflect a banking system that is still fragile.

Small and midsize banks lost billions in deposits that moved primarily to larger banks and money-market funds following the banking turmoil.

Now, while this doesn’t bode well for the regional banking community, there’s another problem popping up, a bit like whack-a-mole.

The next shoe to drop could be in the commercial real estate sector

Commercial real estate is a highly-levered, $20 trillion industry.

For nearly four decades, it has benefited from declining interest rates.

Suddenly, that has reversed.

Worse, it has reversed in the wake of the pandemic, in which many businesses no longer require employees to come into an office. This has reduced demand for office space, which has reduced the rental income many landlords have received.

With this as our background, let’s jump to a recent episode of the Odd Lots podcast.

From co-host Joe Weisenthal:

…Obviously real estate is a highly-leveraged industry in almost any factor, whether it’s malls or office buildings or apartments or single-family homes. There’s a lot of borrowing, so I think rates matter. Like every other industry, it’s dealing with this reversal of a long downtrend.

And then with office REITs in particular, we all know that working from home is still a thing.

Not everyone goes to the office every day like they used to. Companies are reducing footprints.

So, if you are the owner of commercial property, you may be looking at a double whammy in which your loan is set to reset, or your commercial mortgage that you planned to roll over is set to reset.

At the same time, because of vacancies, your business is not as good as maybe it was in 2019. So potentially, a major stress point is emerging for a lot of players.

You have to wonder how much of this “soaring interest rates” iceberg we’ve seen so far, versus how much remains under the water’s surface.

But you don’t go from 0% interest rates to nearly 5% at the fastest clip in history and not expect to break things.

The shattering has begun. Let’s see how wide it goes.

Have a good evening,

Jeff Remsburg

The post Whatâs Behind Bitcoinâs Rally? appeared first on InvestorPlace.

Luke Lango explains why Bitcoin has surged in the wake of banking weakness … gold nearly sets a new all-time-high before pulling back … what the Discount Window is telling us

From “down 15%” to “up 18%.”

That’s what Bitcoin has done over the past two-and-a-half weeks as a slew of headlines have rocked the financial markets.

What’s behind the reversal?

First, two major players in the Bitcoin world, Silvergate and Silicon Valley Bank, crashed, leading to Bitcoin sinking. Fears about crypto liquidity drying up resulted in a swift selloff.

Bitcoin fell nearly 15% from its early-March high as crypto investors ran for cover.

But as the backstops kicked in (not for Silvergate), investors raced back to the market. Bitcoin has soared nearly 40% over the last 11 days, netting out to gain of more than 18% since early in the month.

Here’s how the rollercoaster looks…

Source: StockCharts.com

Now, some Bitcoin bulls believe these gains reflect investors embracing Bitcoin as “digital gold.” In other words, when there’s chaos in financial markets, Bitcoin offers shelter in the storm outside of the traditional banking system.

This might strike you as odd. After all, isn’t Bitcoin a risk-on asset? Isn’t it more closely correlated with riskier technology stocks?

Many investors do hold this belief. However, there’s another seemingly-conflicting view of Bitcoin as an alternative to the dollar and the traditional U.S. banking system. That would make it a risk-off asset for these other investors who want to get away from trouble with the dollar and the banking sector.

Our crypto expert Luke Lango believes some of this risk-off sentiment might be responsible for Bitcoin’s recent surge, but he thinks something else is at play.

How banking failures can goose the crypto sector

Let’s jump to Luke’s weekend update from Ultimate Crypto:

…This rally is mostly about the banking sector meltdown killing prospects for inflation and rate hikes and, by extension, improving prospects for cryptos and risk assets.

Hot inflation and rising interest rates have crushed risk-asset appetite over the past 12 months.

Our bull thesis has long been that in 2023, inflation and interest rates would stop going up and cryptos would start going up.

This is already playing out as we expected.

Just look at the following chart. It graphs the inverse of CPI (in white) alongside BTC (in blue), with BTC lagged by six months. Falling inflation is driving crypto prices higher, and this party looks like it is just getting started.

How does the banking sector meltdown impact these trends?

Positively.

Luke points out that a banking failure is hugely deflationary.

As a bank rolls over, other banks tighten their lending standards. Credit dries up immediately, investment in new business slams on the brakes, and consumer spending slows.

Now, multiply that by what’s happened recently, which is not just one bank failure, but a string of them.

Put it all together, and Luke sees inflation crashing in our near future.

Here he is reconnecting these macro events with crypto:

…As inflation crashes and financial contagion fears spread, the Fed will be forced to stop its rate-hiking campaign.

The consensus belief is that it will hike rates 25 basis points next week before pausing in May. We think this is exactly what will happen.

If things do play out this way, that will be very bullish for cryptos, as illustrated by the chart below.

We remain as confident as ever in our call for a crypto boom cycle in 2023.

Meanwhile, there’s another asset that’s loving the banking sector meltdown

Gold (or should we now call it “analog Bitcoin”?)

Yesterday, gold pushed as high as roughly $2,029. That took it within about 2% of its all-time high of about $2,075. It has since pulled back to 1,967 as I write Tuesday morning.

Now, on one hand, this is crazy.

Even after crashing, the 10-year Treasury bond yields 3.56% as I write. Even better, the two-year Treasury yields 4.13%. And you can find FDIC-insured high-yield savings accounts yielding nearly 5%.

Why would investors put their money into gold, that yields nothing?

Fear.

Though Luke just wrote “this party looks like it is just getting started,” which would support risk-on assets, at least for now, there are plenty of scared investors out there who want safety.

And as we noted in last week’s Digest, gold plays the role of “chaos hedge” in a portfolio.

If we look at the banking sector today, even though the recent fires have been put out, there’s still smoke on the horizon.

In yesterday’s Digest, we showed you this chart of the Fed’s Discount Window

We’ll explain the details of it in a moment. First, just look at the spike back in the 2008/2009 financial market chaos.

Then, notice that our current spike on the far-right side of the chart is even higher.

So, what is this Discount Window, and what is it telling us?

The Discount Window is the Federal Reserve’s primary facility for supporting the U.S. banking system with added liquidity.

The need for added liquidity arises when market chaos and/or operational weakness causes a bank cash shortfall.

Although the Fed wants to support troubled banks, it doesn’t want to be left on the hook if it lends money to a bank that can’t repay the loan. So, historically, the Fed has required these banks to pony up collateral that has a greater value than the loan itself.

This serves two goals: 1) it protects the Fed, 2) it makes borrowing from the Discount Window less attractive to banks. This makes the Discount Window a “break in case of emergency” lending facility.

With this context, let’s go to Bloomberg to better understand the spike we’re seeing today:

To avert further bank runs, a full-blown financial crisis and potential recession, the Fed decided to make it even easier for banks to borrow from the discount window.

It began valuing the collateral it is offered in return for money “at par,” meaning at its face value, rather than follow the usual practice of imposing a haircut. That decision was partly taken to ease the stigma banks often feel exists when forced to borrow from the Fed.

The central bank wanted to make borrowing from it an easier decision to take in the interest of insulating the wider financial system and economy.

It also put the handling of discount window loans in line with a new emergency loan facility it had created.

Bloomberg details this new facility, called The Bank Term Funding Program, which came to be just weeks ago in the wake of the Silicon Valley Bank (SVB) collapse.

That alone should raise an eyebrow. If the SVB problem was just a one-off, or contained, why would we need a brand-new lending facility beyond the Discount Window?

Back to Bloomberg:

Taken together, the credit extended through the two backstops reflect a banking system that is still fragile.

Small and midsize banks lost billions in deposits that moved primarily to larger banks and money-market funds following the banking turmoil.

Now, while this doesn’t bode well for the regional banking community, there’s another problem popping up, a bit like whack-a-mole.

The next shoe to drop could be in the commercial real estate sector

Commercial real estate is a highly-levered, $20 trillion industry.

For nearly four decades, it has benefited from declining interest rates.

Suddenly, that has reversed.

Worse, it has reversed in the wake of the pandemic, in which many businesses no longer require employees to come into an office. This has reduced demand for office space, which has reduced the rental income many landlords have received.

With this as our background, let’s jump to a recent episode of the Odd Lots podcast.

From co-host Joe Weisenthal:

…Obviously real estate is a highly-leveraged industry in almost any factor, whether it’s malls or office buildings or apartments or single-family homes. There’s a lot of borrowing, so I think rates matter. Like every other industry, it’s dealing with this reversal of a long downtrend.

And then with office REITs in particular, we all know that working from home is still a thing.

Not everyone goes to the office every day like they used to. Companies are reducing footprints.

So, if you are the owner of commercial property, you may be looking at a double whammy in which your loan is set to reset, or your commercial mortgage that you planned to roll over is set to reset.

At the same time, because of vacancies, your business is not as good as maybe it was in 2019. So potentially, a major stress point is emerging for a lot of players.

You have to wonder how much of this “soaring interest rates” iceberg we’ve seen so far, versus how much remains under the water’s surface.

But you don’t go from 0% interest rates to nearly 5% at the fastest clip in history and not expect to break things.

The shattering has begun. Let’s see how wide it goes.

Have a good evening,

Jeff Remsburg

The post What’s Behind Bitcoin’s Rally? appeared first on InvestorPlace.