Analysis

Technical Analysis & Forecast for April 2024

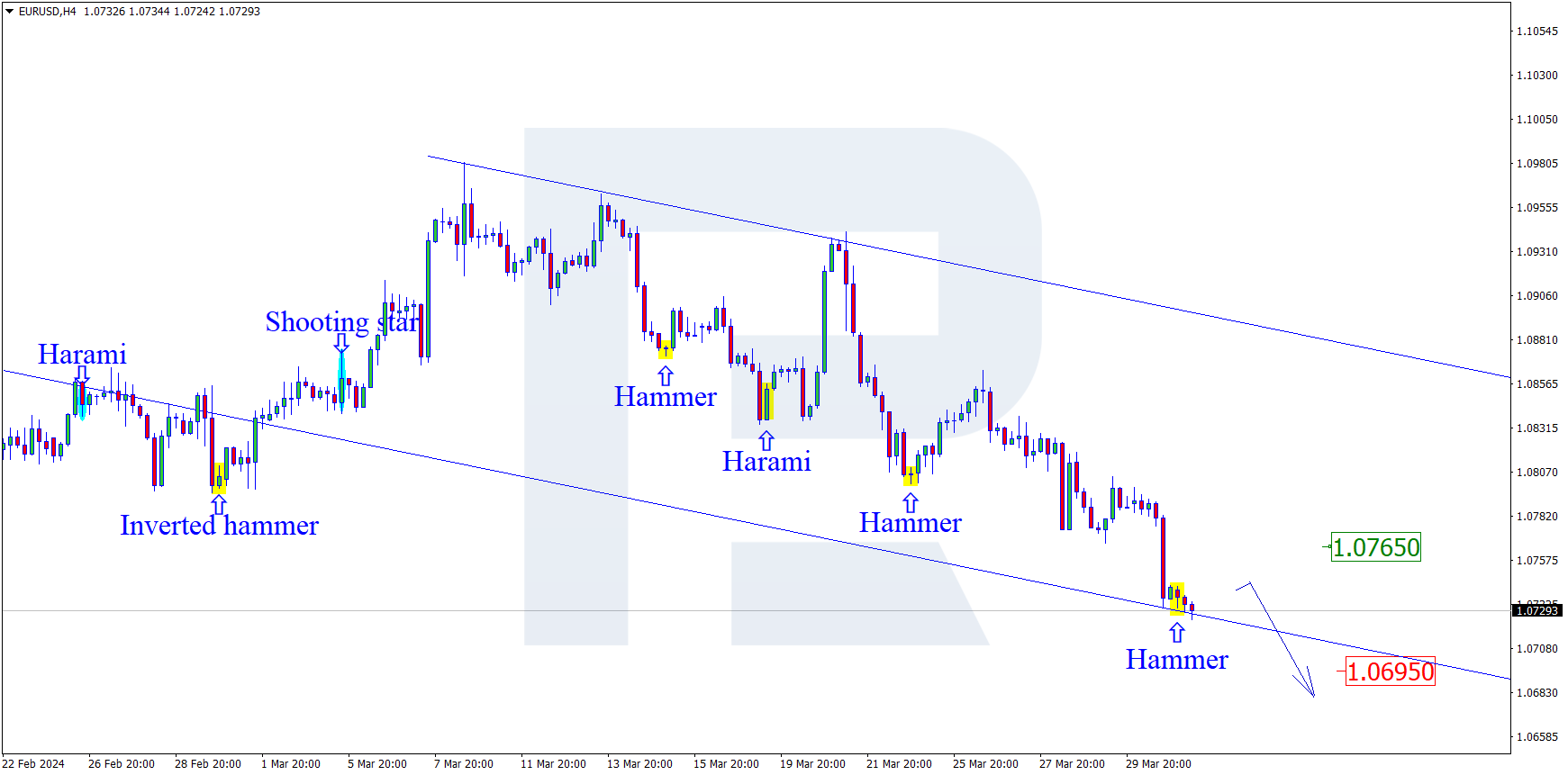

EURUSD, “Euro vs US Dollar”

The EURUSD pair finished correcting towards 1.0975 and started developing the third decline wave to 1.0450. This is the estimated target. By now, the price has formed the first structure of this wave towards …

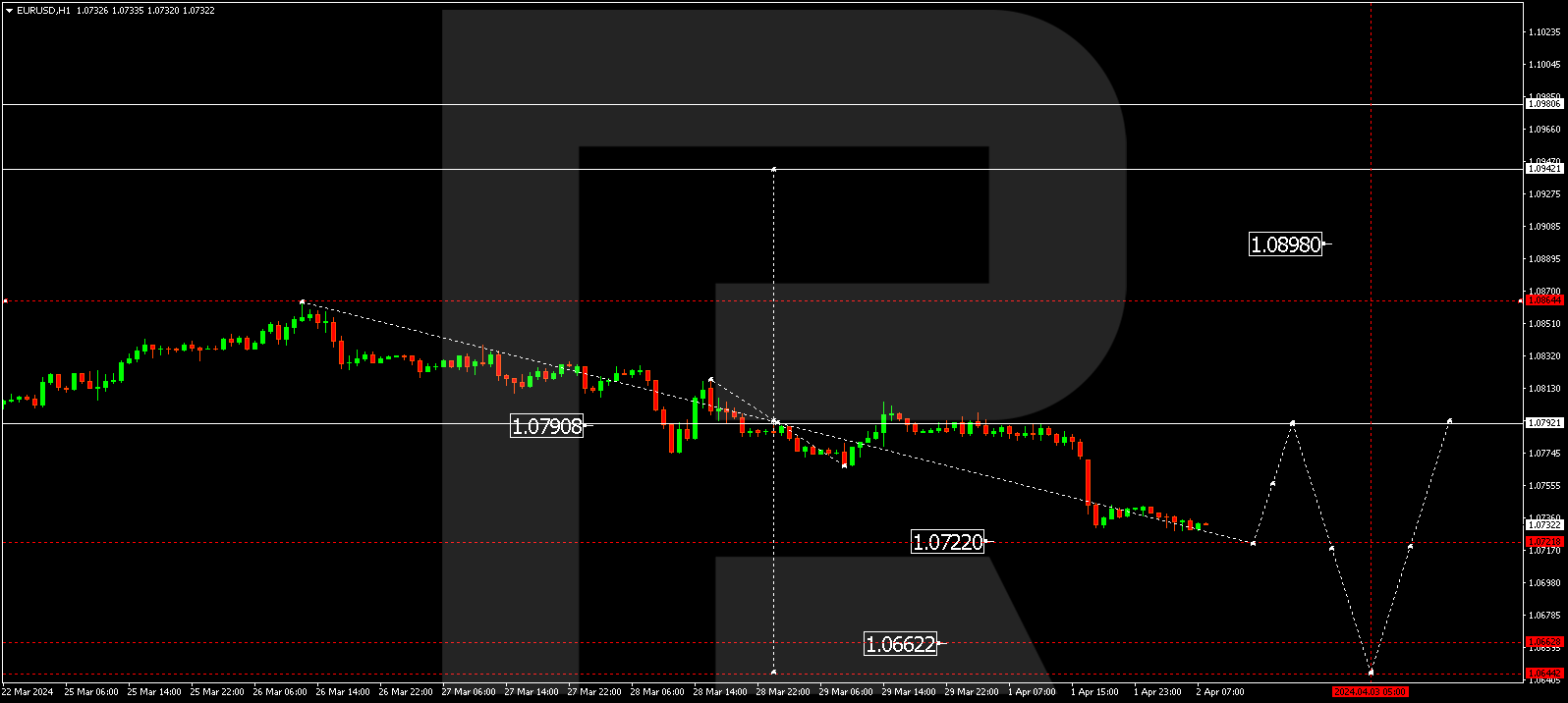

EURUSD, “Euro vs US Dollar”

The EURUSD pair finished correcting towards 1.0975 and started developing the third decline wave to 1.0450. This is the estimated target. By now, the price has formed the first structure of this wave towards 1.0800. A consolidation range could form around this level today. With an escape from the range downwards, the potential for trend continuation towards 1.0650 might open. Once this level is reached, a correction link to 1.0715 could form (testing from below). Next, a decline to 1.0450 might follow. This is a local target.

![]()

![]()

![]()

![]()

![]()

![]()

![]()

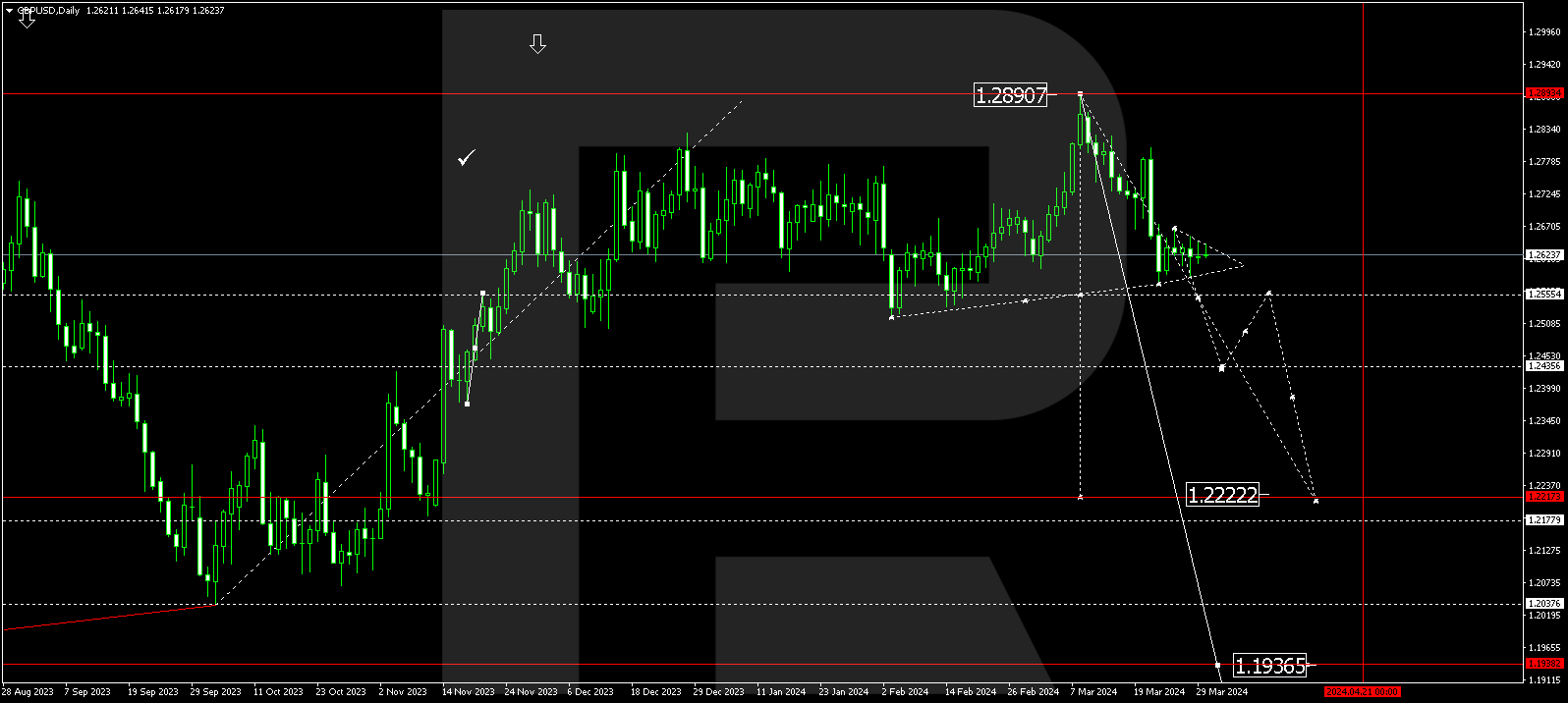

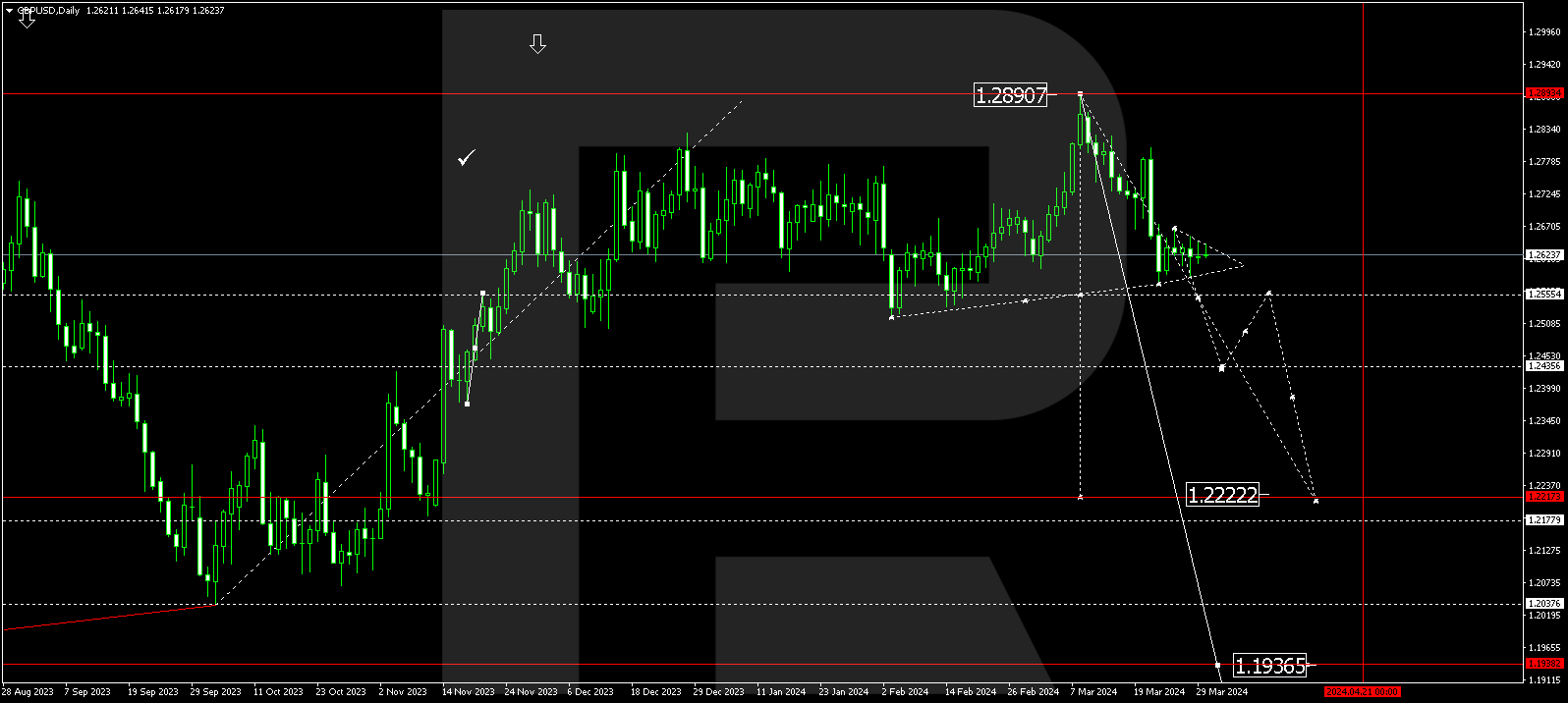

GBPUSD, “Great Britain Pound vs US Dollar”

The GBPUSD pair has completed the first decline wave to 1.2574. Today the market continues developing a consolidation range above this level. An escape from the range downwards is expected, after which the decline wave might extend to 1.2440. Once this level is reached, a correction link to 1.2555 is not excluded (testing from below). Next, the decline wave might extend to 1.2222.

![]()

![]()

![]()

![]()

![]()

![]()

![]()

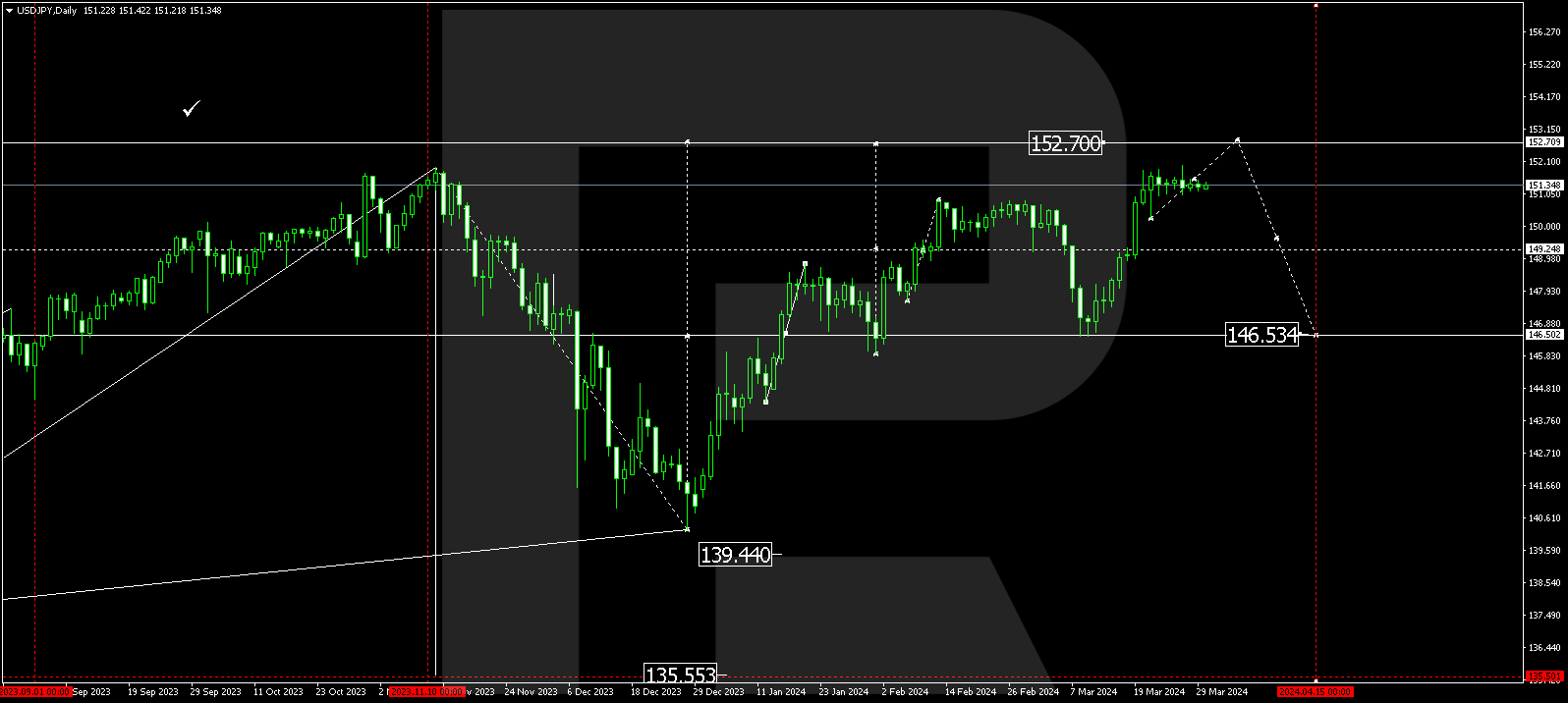

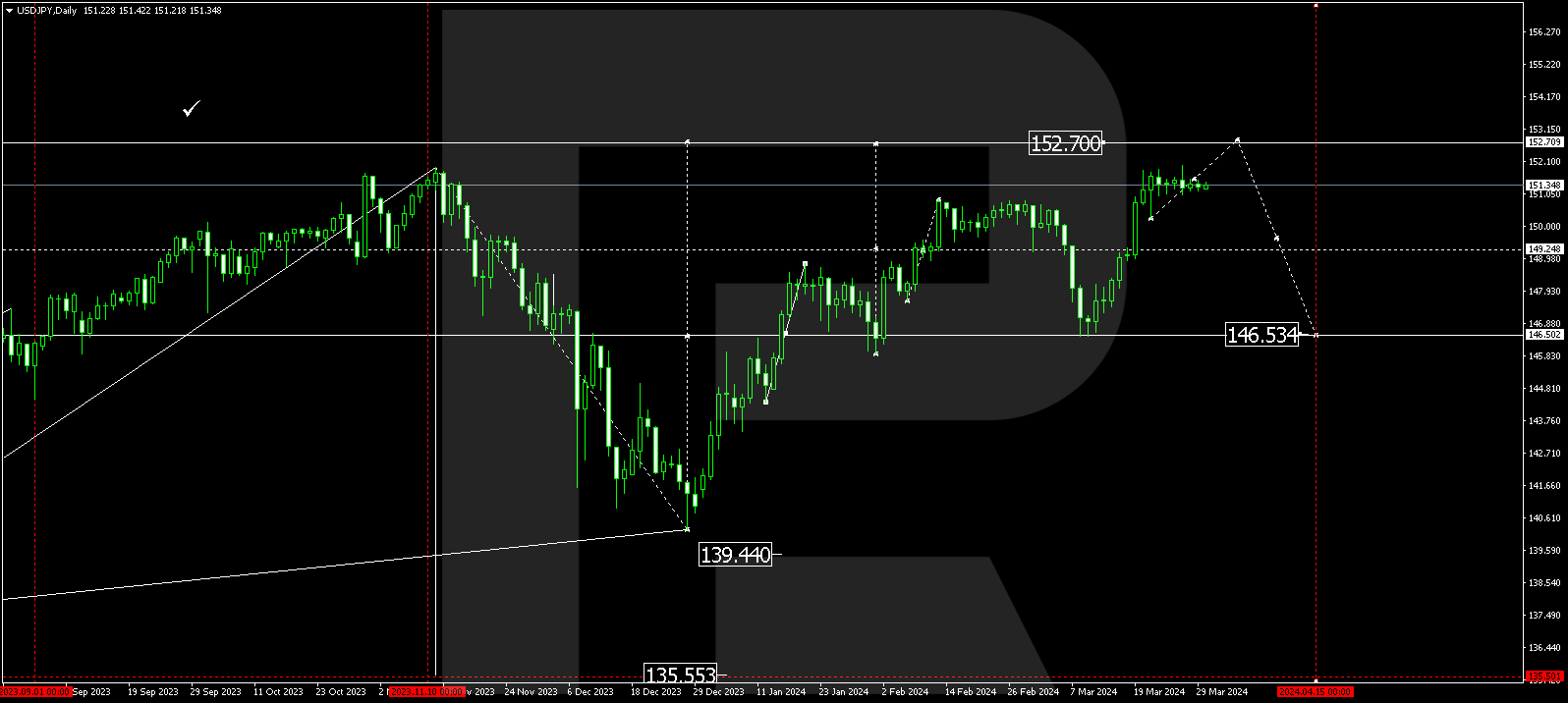

USDJPY, “US Dollar vs Japanese Yen”

The USDJPY pair has completed a correction wave towards 149.55. Today the market continues developing a new growth structure to 152.70. Currently, a consolidation range around 151.33 continues forming. With a downward escape from the range, the quotes could correct to 149.30. Next, a rise to 152.70 might follow. With an upward escape from the range, the growth wave could continue straight to 152.70. Once this level is reached, the price might correct to 146.55.

![]()

![]()

![]()

![]()

![]()

![]()

![]()

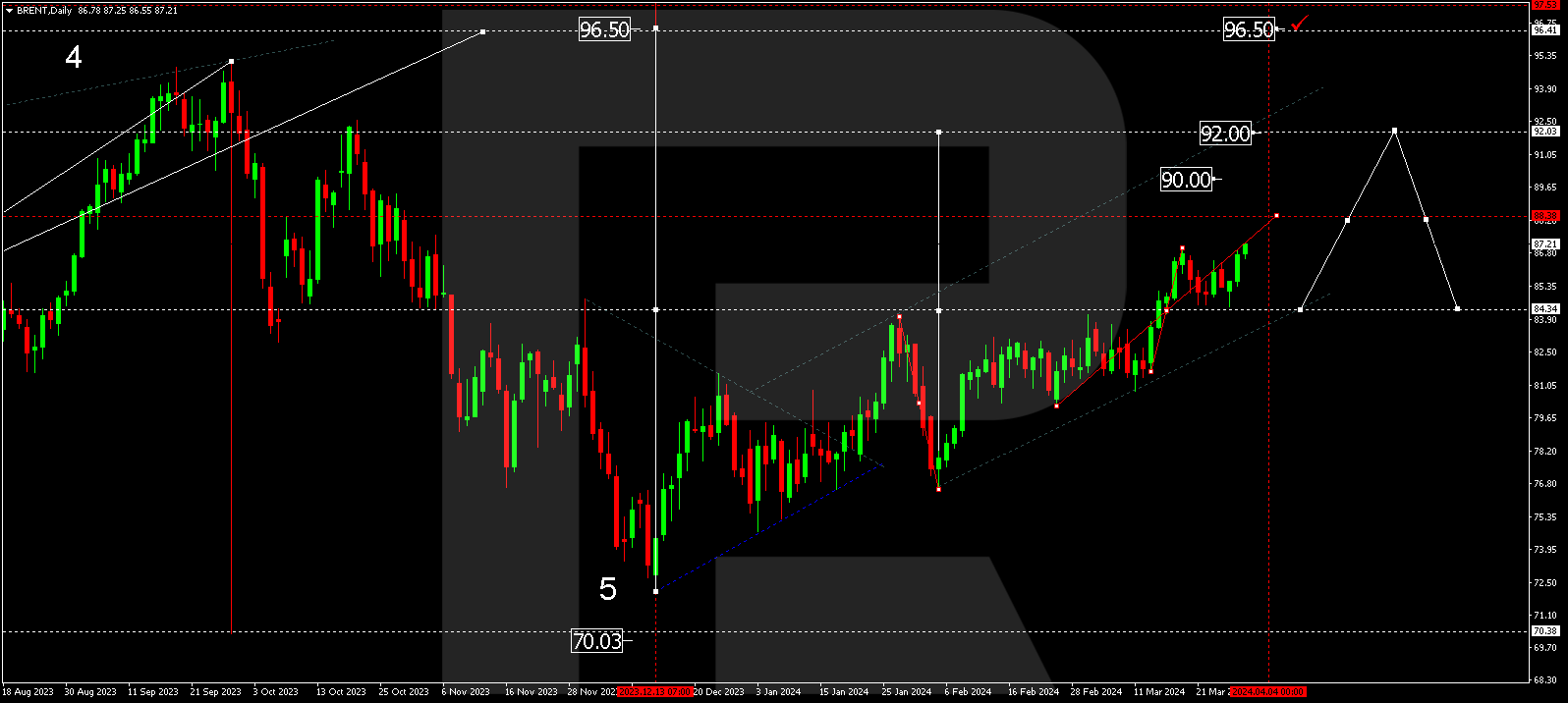

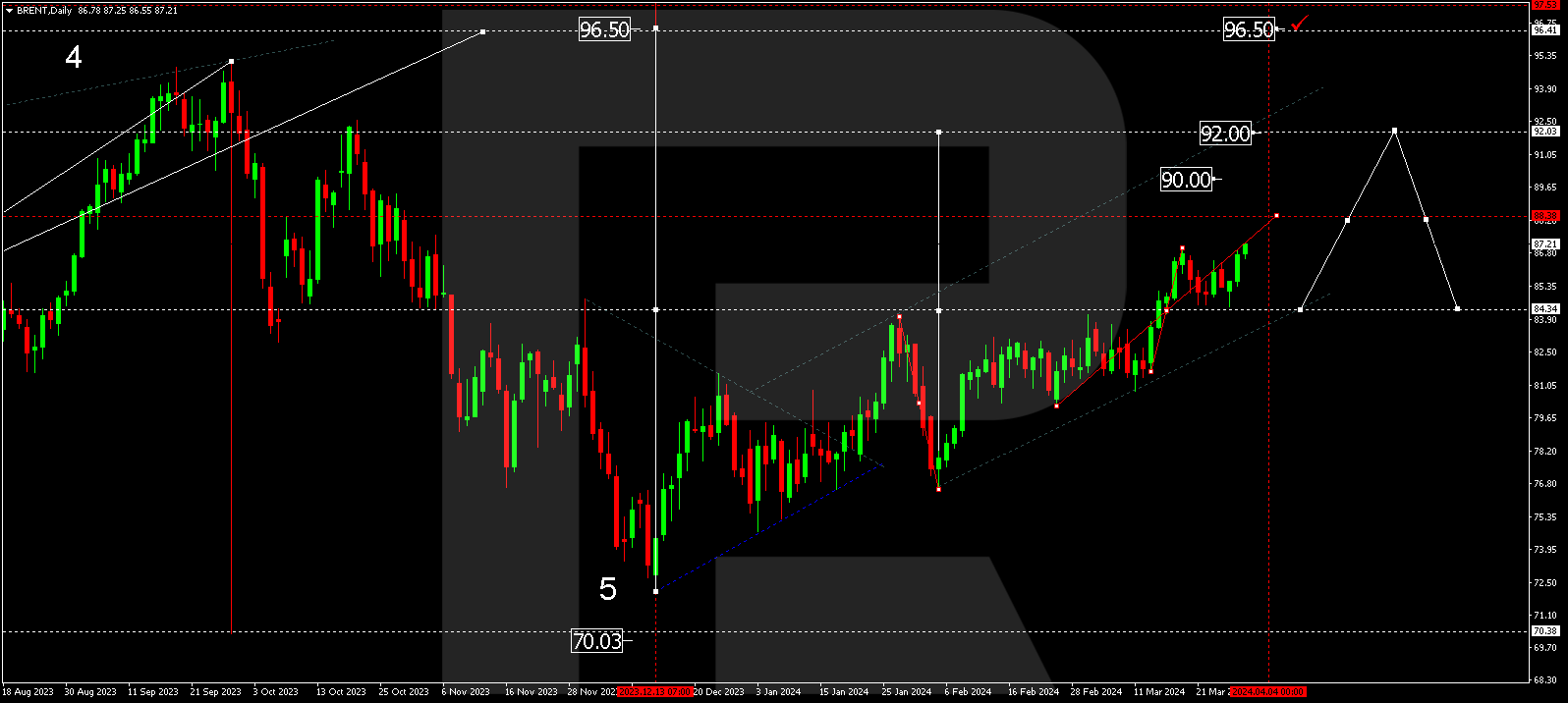

BRENT

Brent has practically formed a consolidation range around 84.35. By now, the market has extended it upwards to 87.00, technically returning to the previously broken 84.45 level. Now we notice attempts to escape this range upwards, targeting 88.40, from which level the trend might extend to 90.00. This is a local target. Once it is reached, a correction link to 87.00 is not excluded. Next, a rise to 92.00 is expected, from which level the trend might extend to 96.50. This is the first target.

![]()

![]()

![]()

![]()

![]()

![]()

![]()

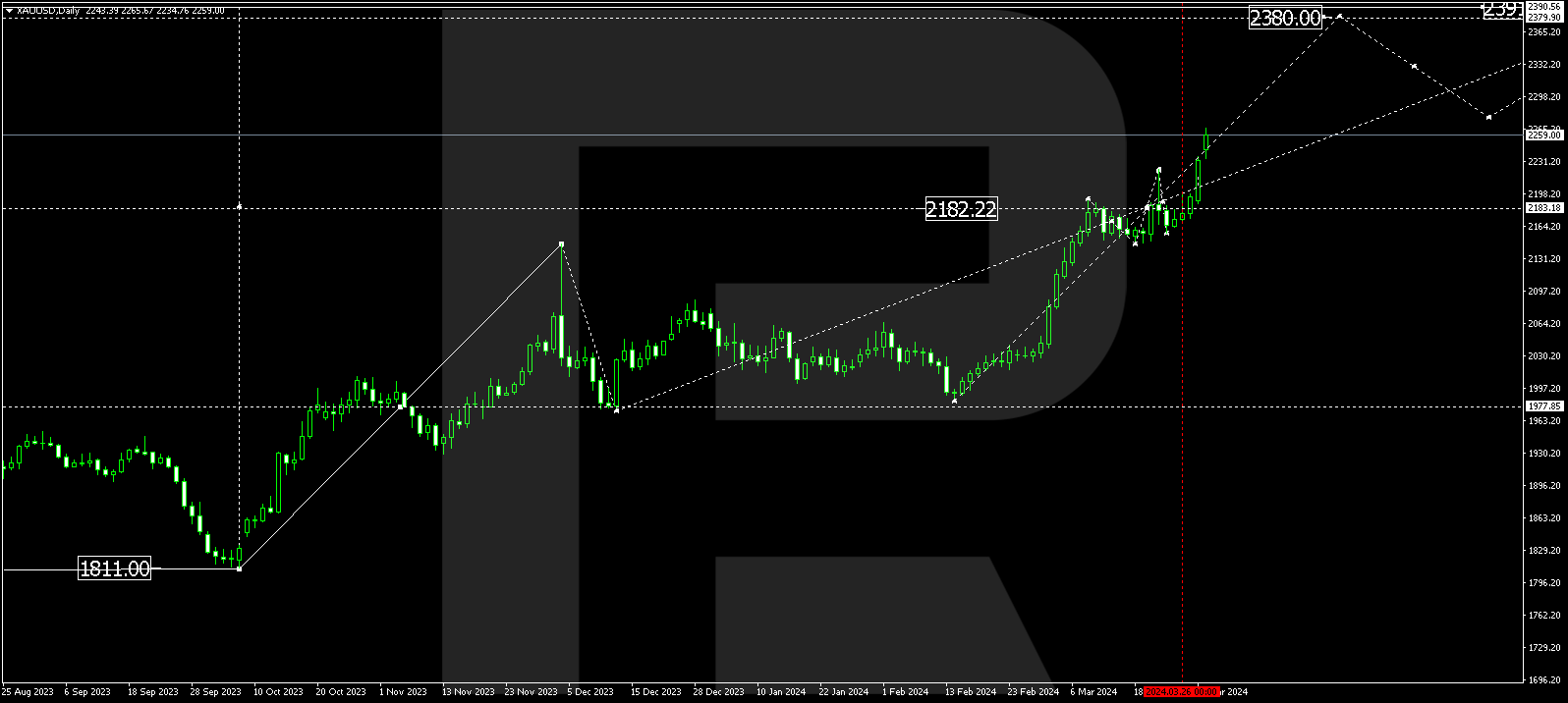

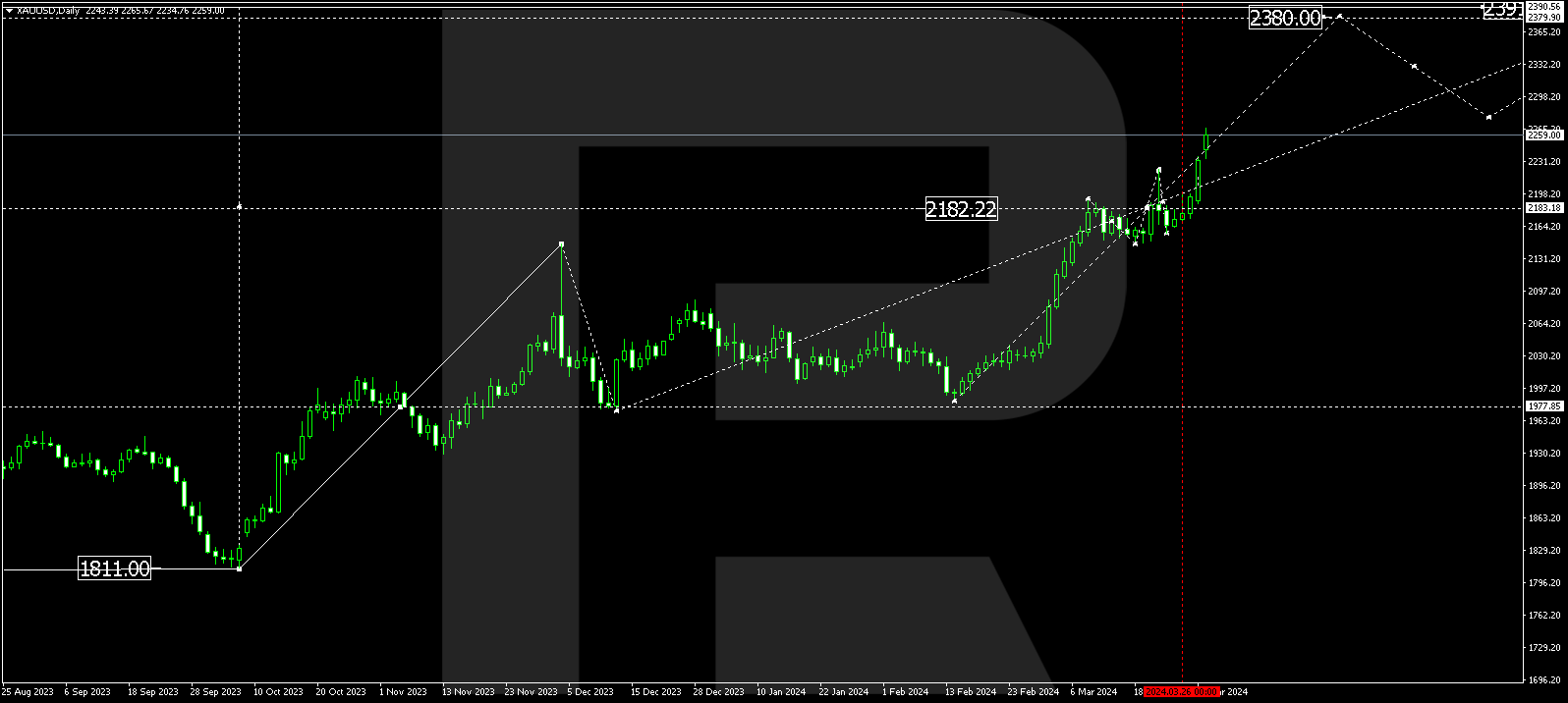

XAUUSD, “Gold vs US Dollar”

Gold has formed a consolidation range around 2183.00 and suggests extending the growth wave towards 2380.00 with an upward escape from the range. Once this level is reached, a correction wave to 2277.00 might follow. Next, the trend could continue upwards to 2390.00. This is a local target.

![]()

![]()

![]()

![]()

![]()

![]()

![]()

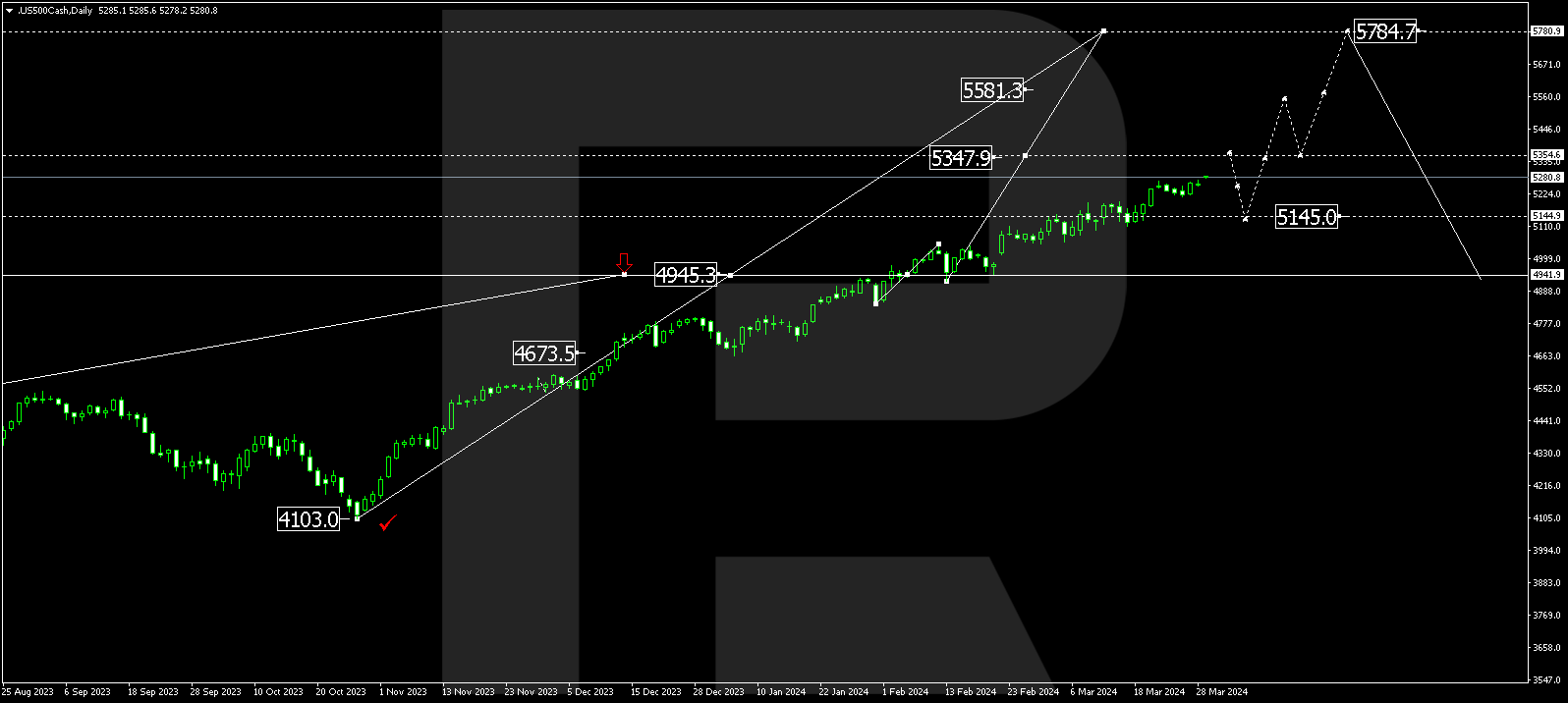

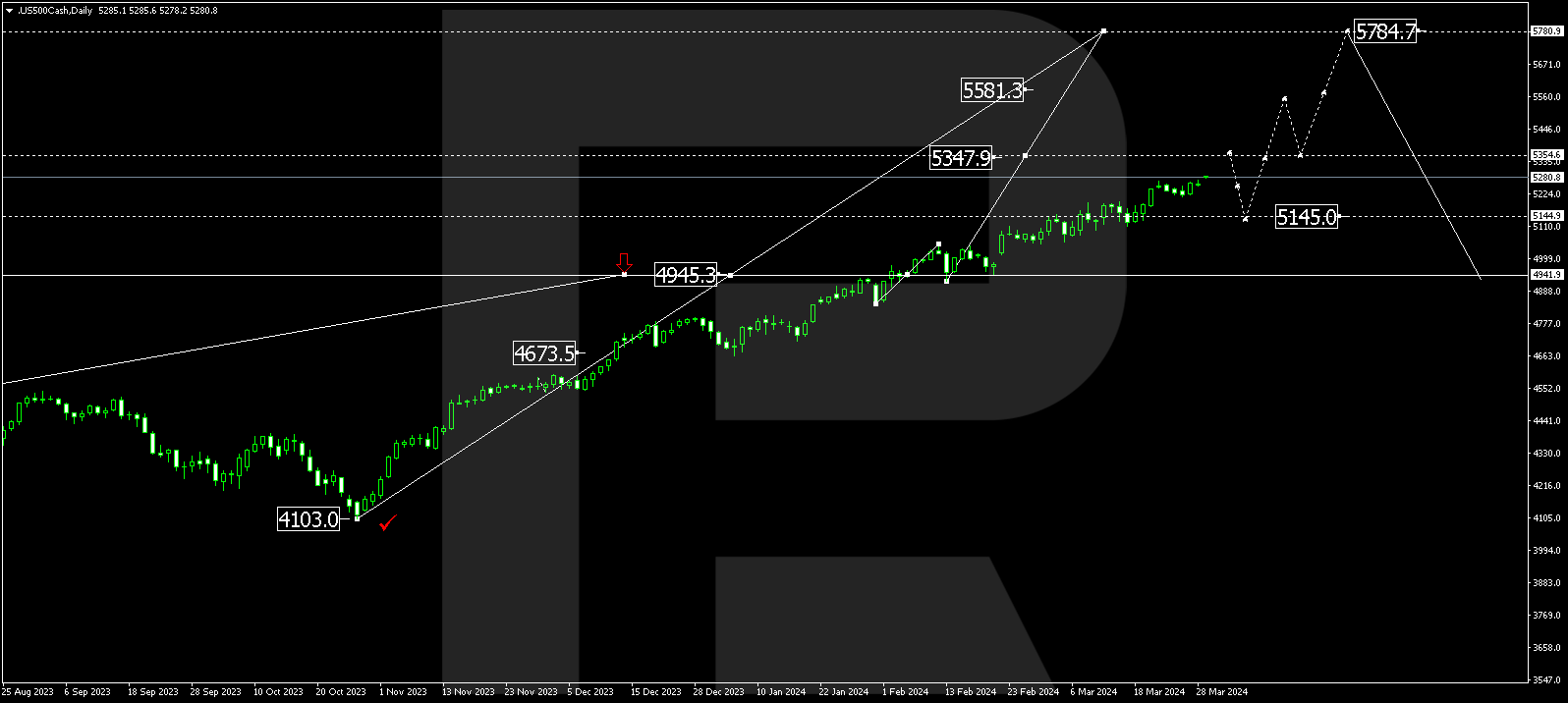

S&P 500

The stock index has formed a consolidation range around 5145.0. Escaping it upwards today, the market suggests extending the growth wave to 5354.5. This is a local target. Next, a correction link to 5145.0 could follow (testing from above), after which the trend could continue to 5784.7. This is the first target.

![]()

![]()

![]()

![]()

![]()

![]()

![]()