Stocks

This Is the Most Explosive Corner of the Stock Market (Hint: It’s Not AI)

Editor’s Note: Eric Fry here. Below, I have a special guest issue from InvestorPlace Senior Investment Analyst, Luke Lango to highlight his Primed Stocks Summit event on July 11. While AI is top of mind for most investors right now, ther…

Editor’s Note: Eric Fry here. Below, I have a special guest issue from InvestorPlace Senior Investment Analyst, Luke Lango to highlight his Primed Stocks Summit event on July 11. While AI is top of mind for most investors right now, there is a new explosive corner in the market that many don’t realize. And during this must-see event Lango uncovers a new “backdoor” strategy to play this megatrend. Reserve your spot here.

What if I told you that one tiny sector of the stock market was regularly responsible for more than 30% of the market’s biggest winners?

Not just this year. But every year. Every day. Every month. Every week. All the time.

You’d look at me skeptically. Maybe you’d call me crazy. But, nonetheless, it is true.

I’m looking at this year’s leaderboard right now; five of the top 10 best-performing stocks are from this tiny sector.

Over the past year, this sector accounts for six of the top 10 best-performing stocks.

In 2021, it accounted for four of the top 10 stocks.

In 2020, five of the top 10 stocks were from this sector.

In 2019, three of the top 10 stocks were from this sector.

Pretty amazing, right?

One tiny sector of the market – which, by my calculation, collectively accounts for less than 1% of the market’s total value – regularly accounts for more than 30% of the market’s best-performing stocks.

These are the most explosive stocks in the market.

But they have one fatal flaw: They’re exceptionally risky.

So far in 2023, this sector accounts for five of the top 10 best-performing stocks. It also accounts for four of the 10 worst-performing stocks.

This sector is the quintessence of high-risk, high-reward.

That’s probably why you and 99% of investors avoid this sector altogether. It’s too risky.

But what if there is a way to invest in the sector while mitigating risk? What if there was a way to tap into this sector’s regularly huge profit potential while reducing downside exposure?

Theoretically, that would be the best trading strategy on the planet.

Well, it is a trading strategy we just developed.

Here’s a deeper look.

NOW OPEN: Register for Our First Ever “Primed Stocks” Summit

On Tuesday, Jul. 11 at 7:00 p.m. ET, Luke Lango will reveal a unique strategy to tap into a corner of the stock market that has churned out 47 triple-digit winners in the past six months alone.

Click here to learn more.

Something’s Always Going Up

No matter what’s happening in the broader market indices… no matter how many crises might be popping up around the globe… there is always a sector, an asset class, or a group of stocks that’s surging – and making its investors fistfuls of money.

Why? Because we live in an $80 TRILLION global economy.

Not $80 million. Or even $80 billion. $80 trillion. That’s a lot of money. So much money, in fact, that you can guarantee that not all $80 trillion are going to always move in the same direction.

Let’s pull out the sports analogies.

Even the worst free throw shooter in the world will hit at least a few free throws… if you give him or her 80 trillion shots.

Even the worst batter will hit the ball a few times… if you pitch to him or her 80 trillion times.

By the same token, even a few stocks will rise in the worst of macroeconomic conditions… if you give those stocks $80 trillion to work with.

In our global economy, something is always going up, and something is always going down. Both are always true.

That’s why, instead of focusing on what “the market” is doing, I recommend you keep in mind that it’s not so much a stock market as it is a market of individual stocks.

And thanks to these individual stocks’ wildly differing fates, there’s always a bull market printing money for investors who know where to look.

Huge Opportunity in the Hidden Bull Markets

Let’s take this a step further to make sure we’re on the same page.

When I write “bull market”, I don’t mean gains of 25%, 30%, or even 50%.

Now, I’m not scoffing at those returns. Who doesn’t want to make 50% on an investment?

But when I write about the bull market, I’m talking about 100%-plus returns in a single year or even a few months – and again, this is regardless of what’s happening in the S&P 500 or the Nasdaq, in the commodities market, or elsewhere.

Let’s put some real numbers on this so that you can see for yourself…

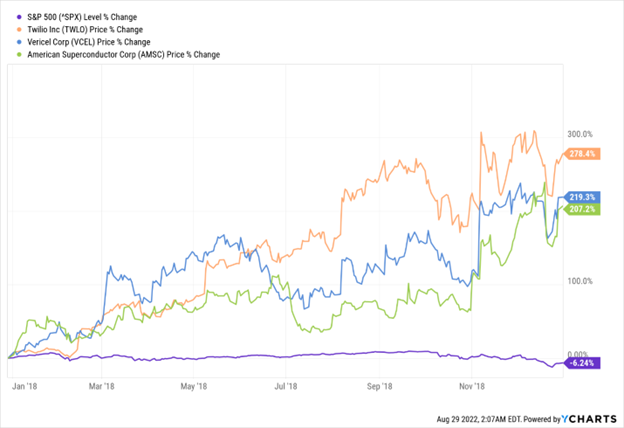

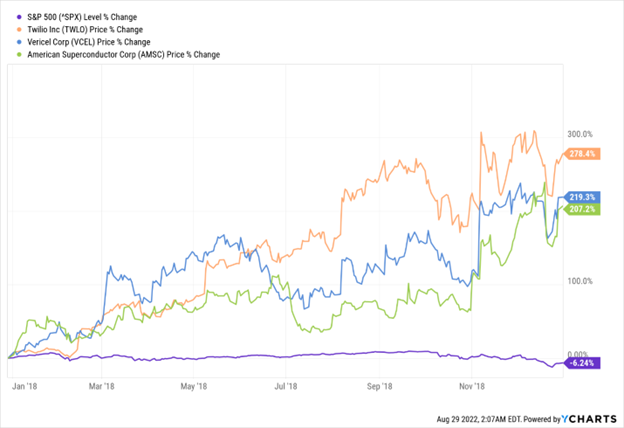

In 2018, the S&P 500 fell by 6.24% for the whole year.

Meanwhile, over that same 12-month period, Bright Mountain Media (BMTM) soared 360%… Twilio (TWLO) climbed 278%… Vericel (VCEL) rose 219%… and American Superconductor (AMSC) jumped 207%…

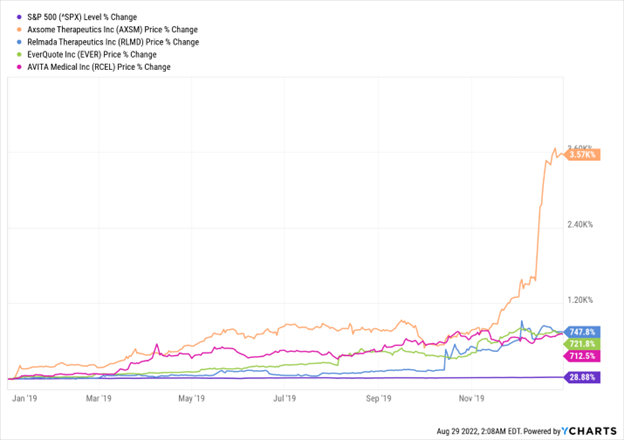

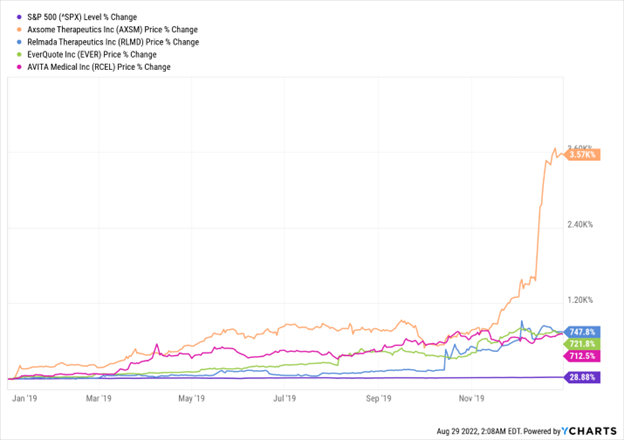

Now, in 2019, the S&P had a great year, up 29%.

But that bull market was nothing compared to what happened in Axsome Therapeutics (AXSM), which erupted 3,565% over those same 12 months… or Relmada Therapeutics (RLMD), up 748%… or EverQuote (EVER), which climbed 722%… or AVITA Medical (RCEL), up 713%.

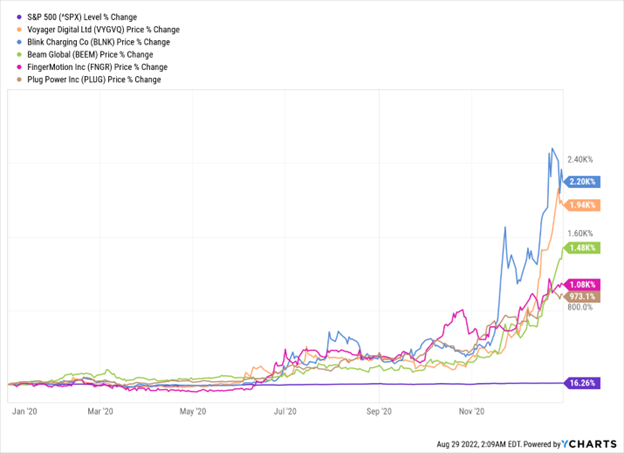

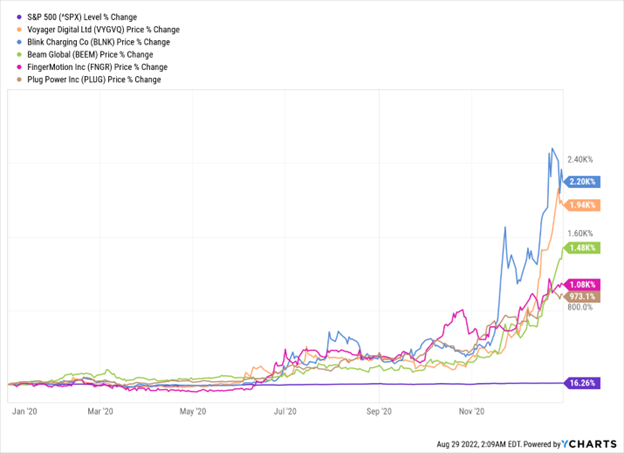

And that brings us to 2020 and the Covid-19 pandemic. Despite falling more than 30% during the bear-market low, the S&P climbed 16% on the year.

Meanwhile, Blink Charging (BLNK) made its investors 2,190%… Beam Global (BEEM) soared 1,483%… FingerMotion (FNGR) added 1,084%… and Plug Power (PLUG) climbed 973%…

All in just one year.

Even last year, in 2022, with the worst inflation in 40 years and stocks getting pummeled, you’re kidding yourself if you think there weren’t localized bull markets.

Take energy and shipping stocks, for instance.

Thanks to severe tightness in the oil market and the Russia-Ukraine war, the price of oil popped in the first-half of last year, which sent oil and gas stocks soaring, and allowed some traders to make a lot of money in oil stocks.

This was also a huge boon for certain shipping stocks that load exports of diesel and gasoline.

You could have done well with any of the big oil names – Exxon (XOM), Chevron (CVX), or BP (BP). In the first half of 2022, they all gained more than 30%.

But a moment ago, we talked about 100%-plus returns. How about 1,000%-plus returns?

One oil & gas stock – Nine Energy Services (NINE) rose 1,300% from early 2022 to early 2023.

Again, this was in less than 12 months – and during a broad bear market.

This is not an anomaly.

These individualized bull markets happen all the time, and they make their investors big-time returns.

So, the question becomes: Where is the hidden bull market today?

Well, that brings us to our brand-new quantitative trading system.

The Final Word

Tech stocks are in a bull market. AI stocks are in a bull market. Semiconductor stocks are in a bull market. Housing stocks are in a bull market.

There are bull markets literally everywhere right now.

But none as explosive as the hidden bull market we’ve found to be the most explosive corner of the market – a corner that, on any given day, week, month, or year, accounts for more than 30% of the market’s top performing stocks.

There are literally hundreds of stocks in this specific hidden bull market that could soar 1,000% in less than a year.

Of course, there’s a catch: Investing in this particular hidden bull market can be very, very risky.

But my team and I just developed a quantitative trading model to remove the guesswork and reduce the risk from investing in this particularly explosive sector.

We’ve developed a “smart” way to invest in the most explosive hidden bull market on Wall Street.

But know that this corner of the market is only for the most serious traders.

High-risk, high-reward.

If that sounds like you, then I urge you to attend our Grand Debut event on Tuesday, July 11, at 7 p.m. EST, when we will unveil this high-octane quantitative trading system for the first time ever.

Click here to reserve your seat now.

Sincerely,

Senior Investment Analyst

Eric Fry is an award-winning stock picker with numerous “10-bagger” calls — in good markets AND bad. How? By finding potent global megatrends… before they take off. In fact, Eric has recommended 41 different 1,000%+ stock market winners in his career. Plus, he beat 650 of the world’s most famous investors (including Bill Ackman and David Einhorn) in a contest. And today he’s revealing his next potential 1,000% winner for free, here.

The post This Is the Most Explosive Corner of the Stock Market (Hint: It’s Not AI) appeared first on InvestorPlace.