Analysis

Forex Technical Analysis & Forecast 04.08.2022

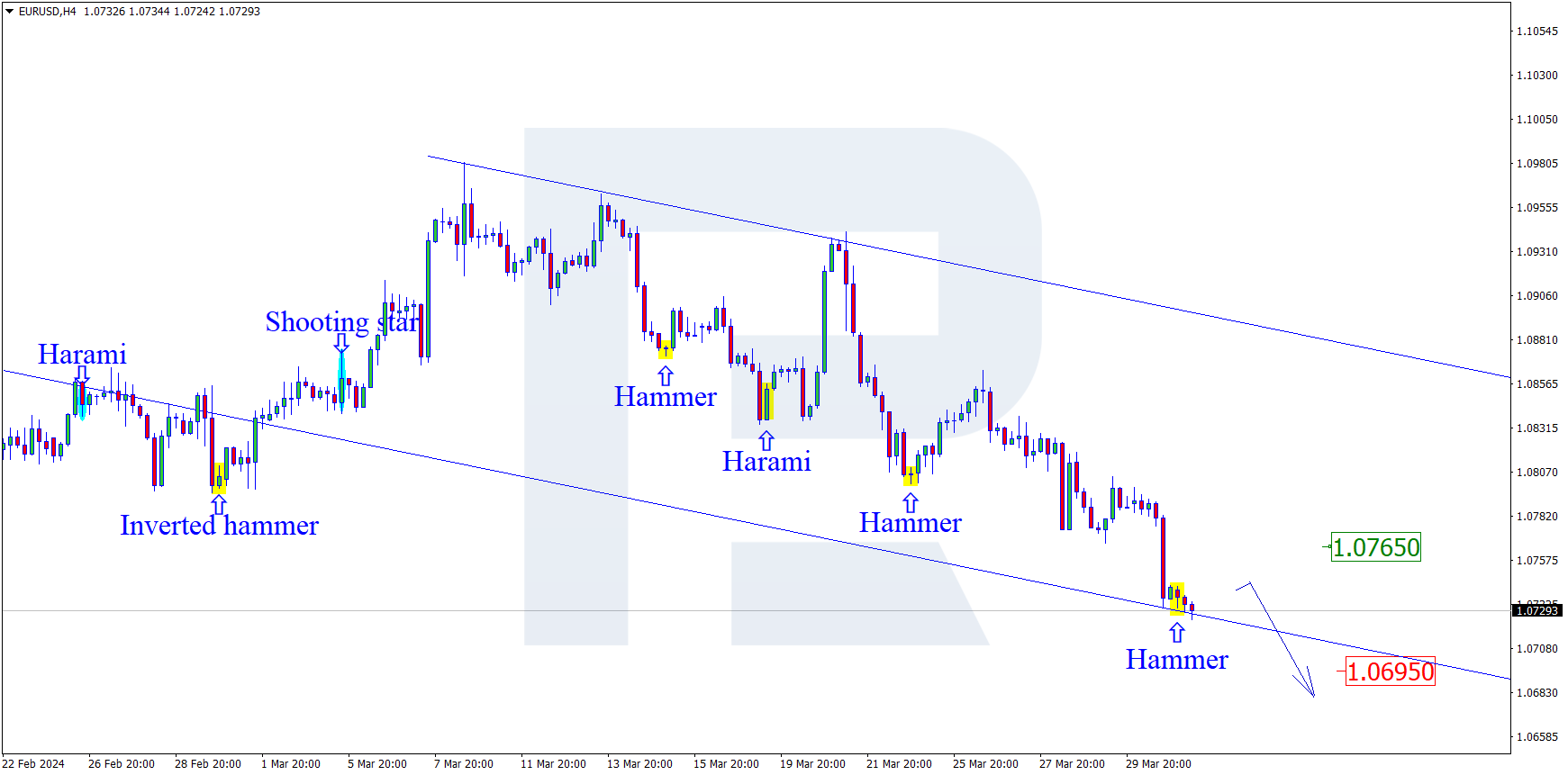

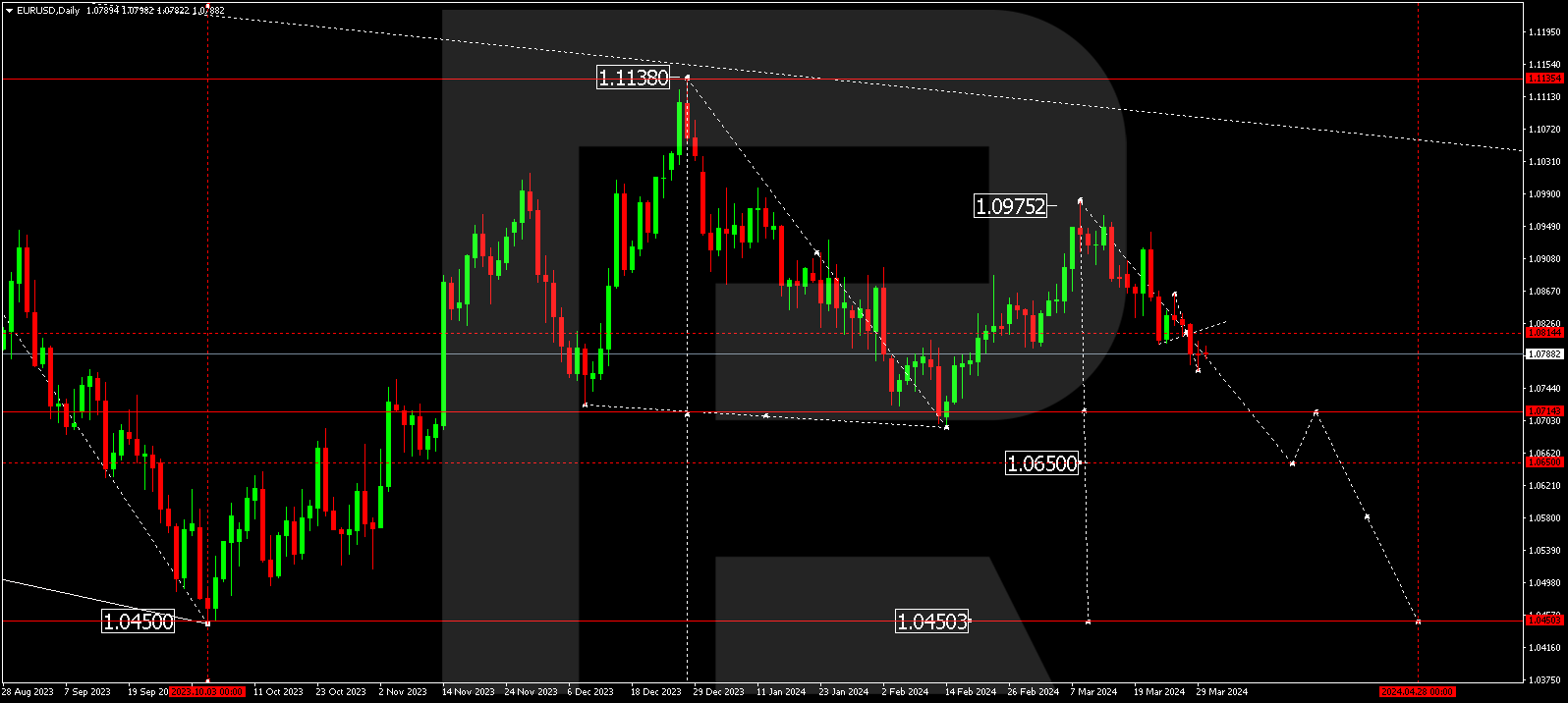

EURUSD, “Euro vs US Dollar”

After finishing the descending wave at 1.0122, EURUSD is correcting up to 1.0197. Later, the market may resume trading downwards with the target at 1.0078 and then form one more ascending structure towards 1.0…

EURUSD, “Euro vs US Dollar”

After finishing the descending wave at 1.0122, EURUSD is correcting up to 1.0197. Later, the market may resume trading downwards with the target at 1.0078 and then form one more ascending structure towards 1.0190.

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

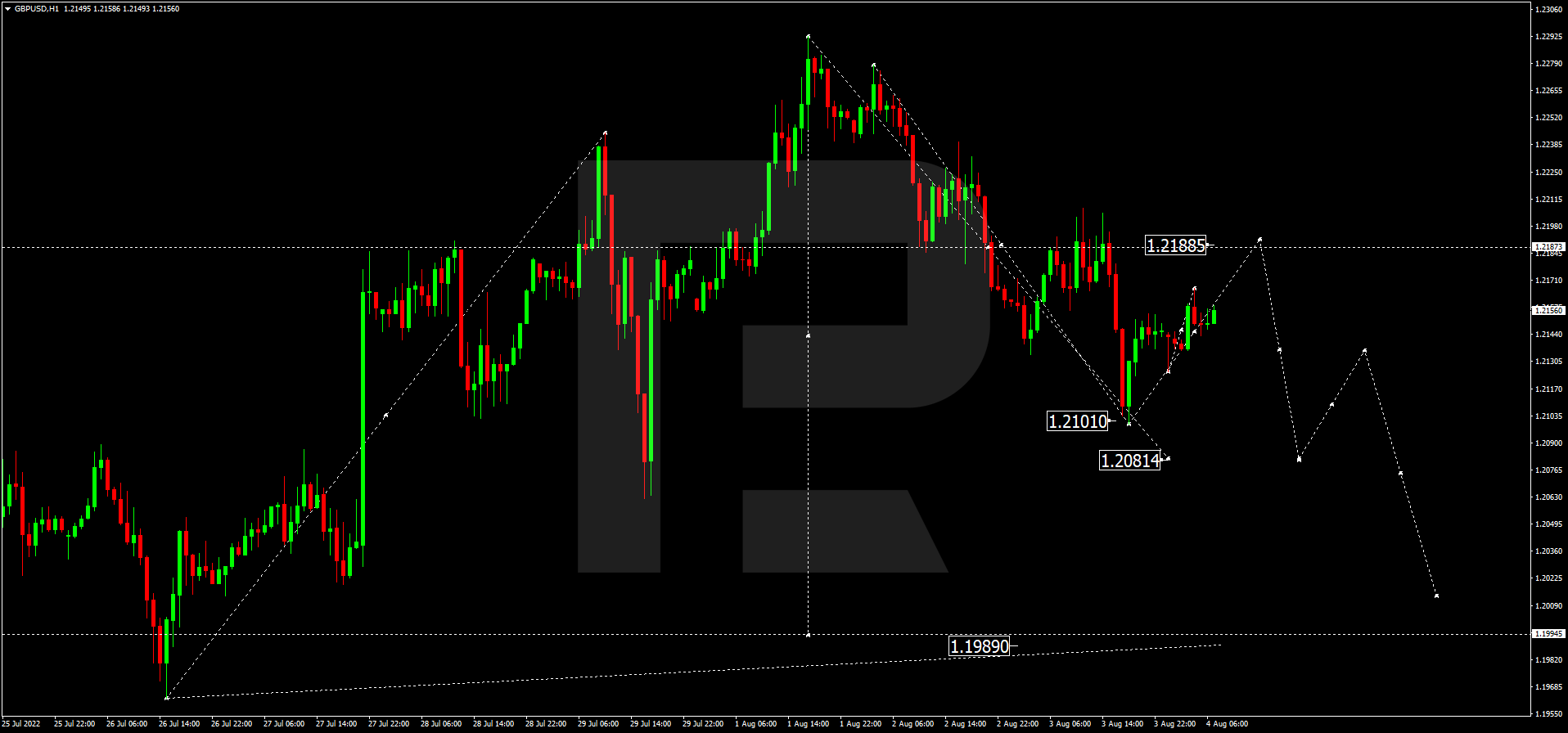

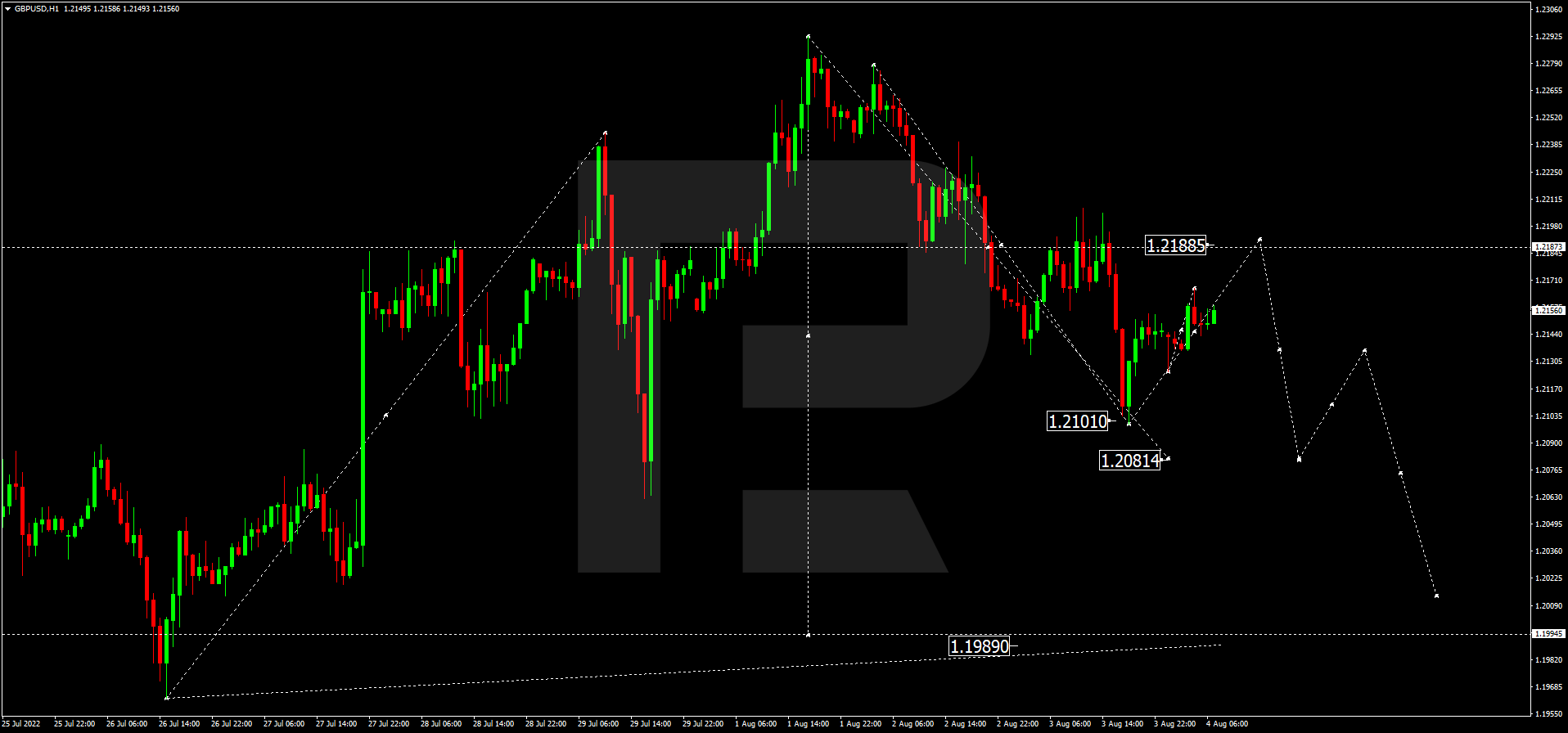

GBPUSD, “Great Britain Pound vs US Dollar”

GBPUSD has completed the descending wave at 1.2100; right now, it is correcting up to 1.2188. After that, the instrument may start another decline to reach 1.2081, or even extend this structure down to 1.1990.

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

USDJPY, “US Dollar vs Japanese Yen”

USDJPY continues the correction towards 134.46; right now, it is consolidating below this level. Possibly, the pair may start a new decline with the target at 132.26, or even extend this structure down to 129.50.

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

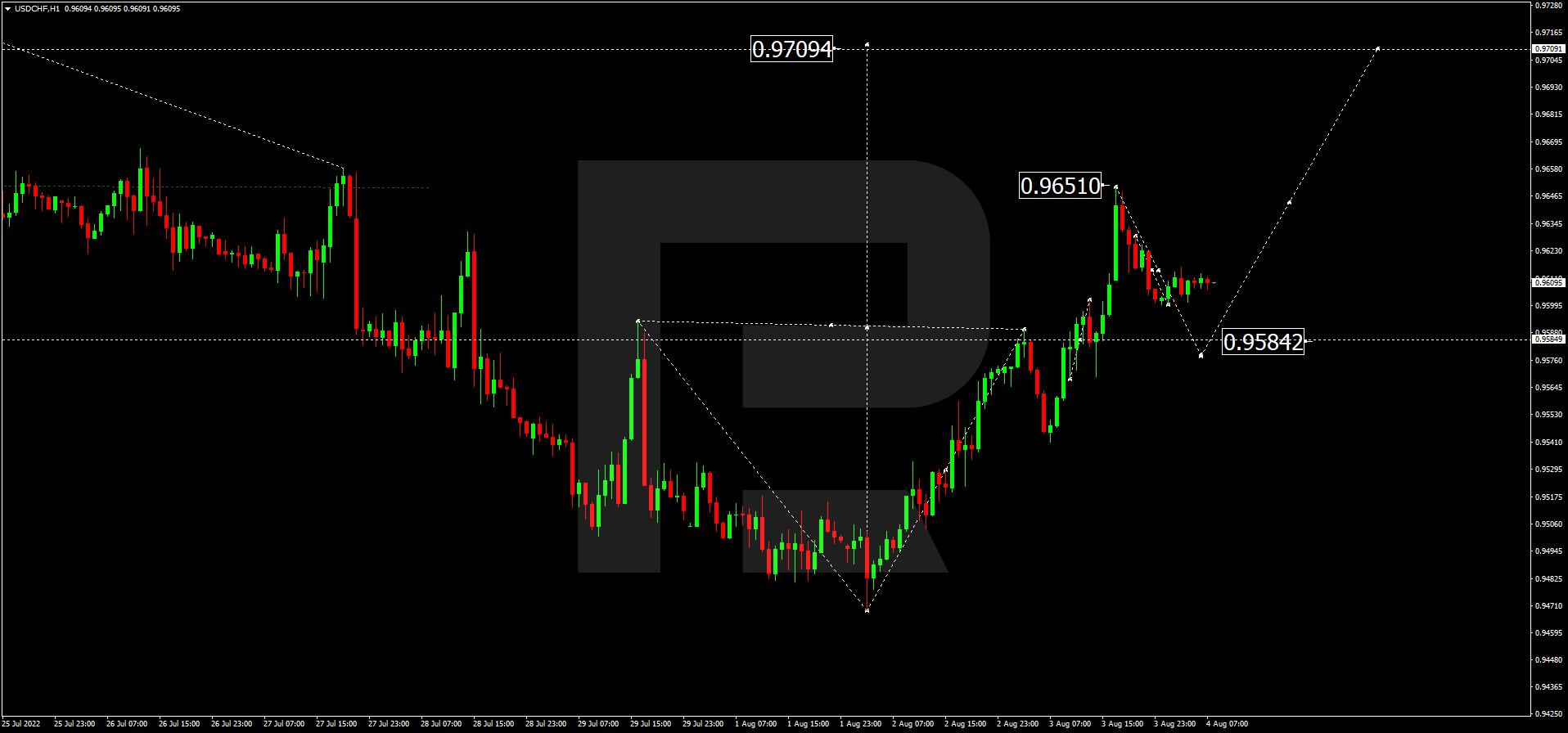

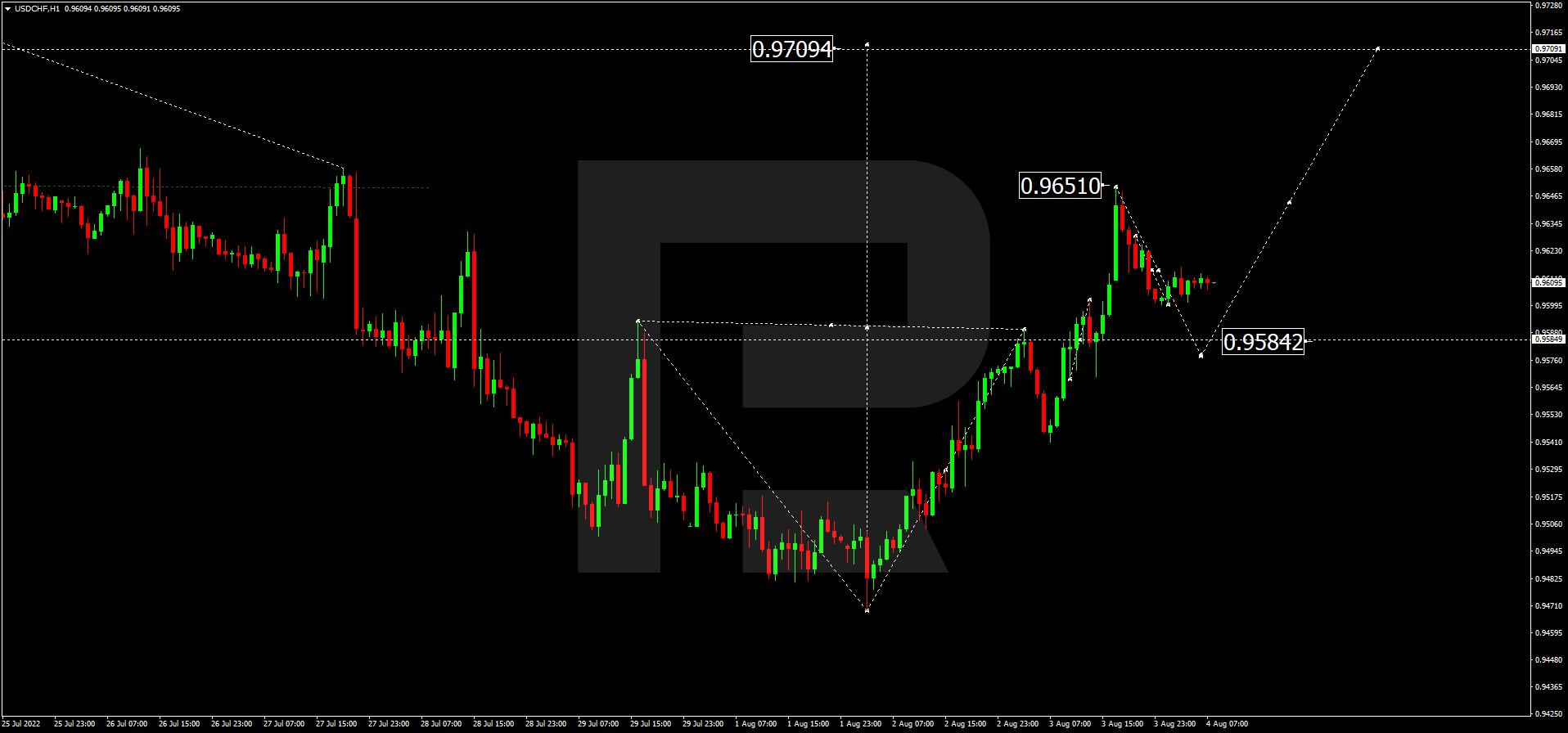

USDCHF, “US Dollar vs Swiss Franc”

Having completed the ascending wave at 0.9651, USDCHF is expected to correct down to 0.9584. After that, the instrument may grow towards 0.9700 and then form a new consolidation range below this level. If later the price breaks the range to the downside, the market may start another correction to reach 0.9580; if to the upside – form one more ascending structure with the target at 0.9800.

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

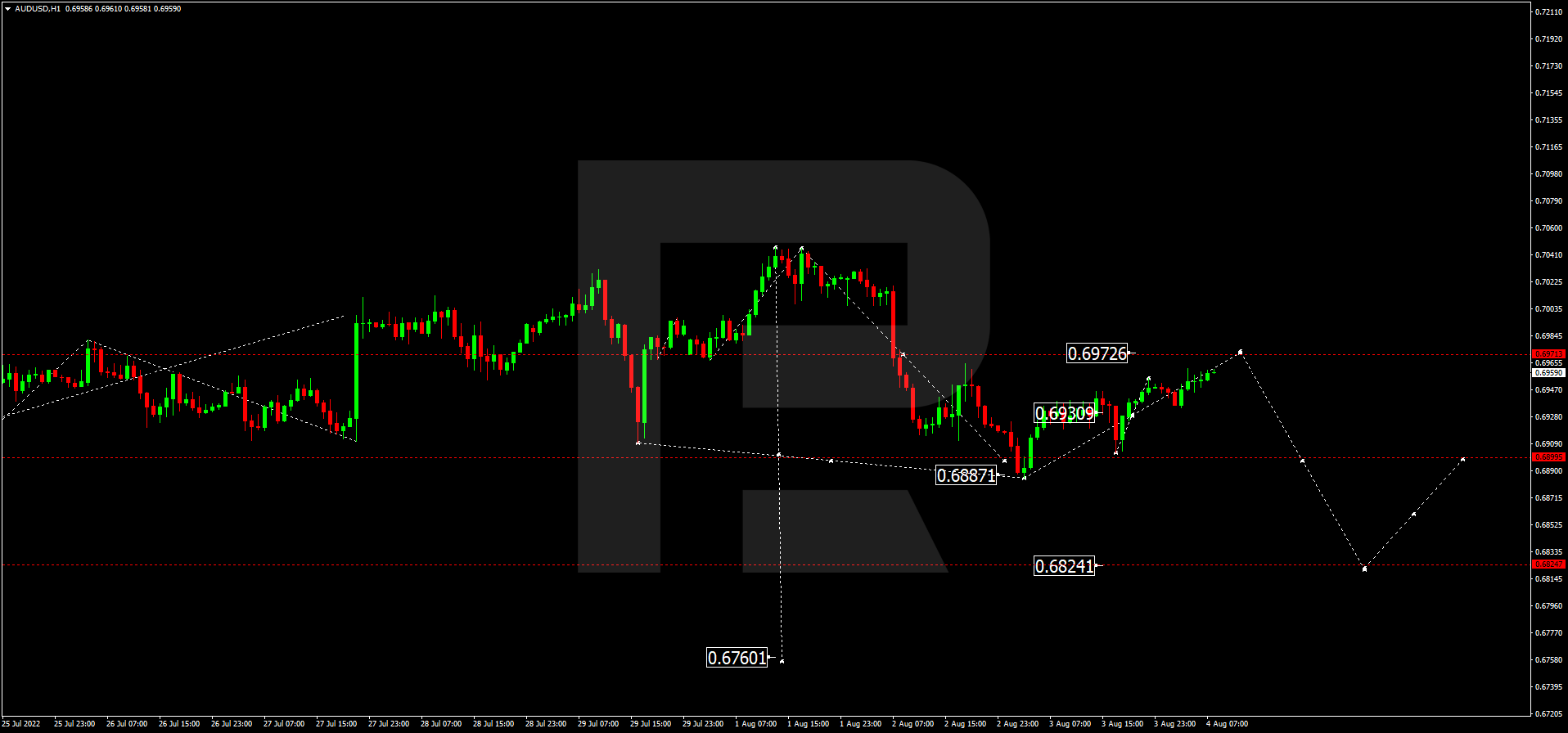

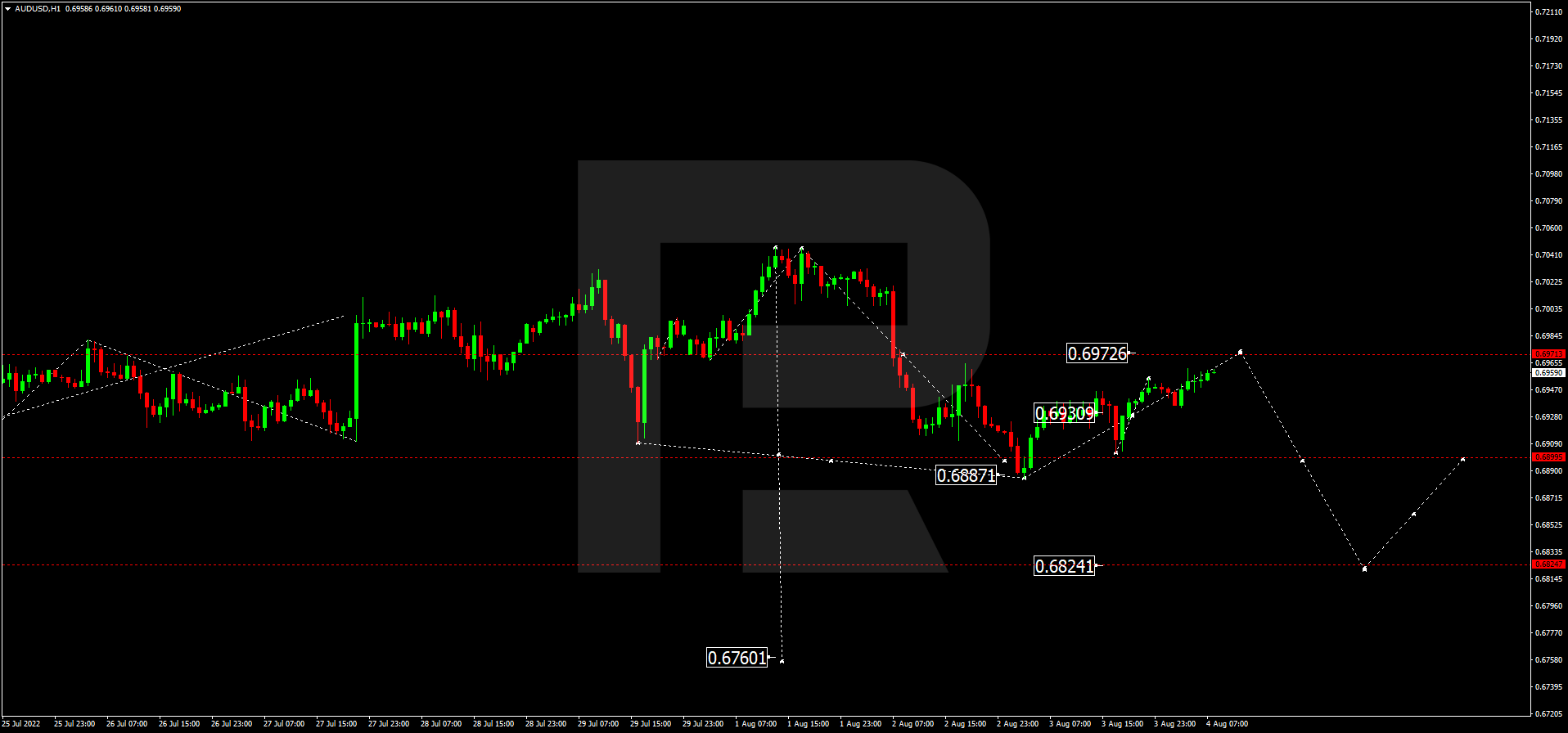

AUDUSD, “Australian Dollar vs US Dollar”

AUDUSD is still correcting up to 0.6972. After that, the instrument may resume falling with the target at 0.6824, or even extend this structure down to 0.6760.

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

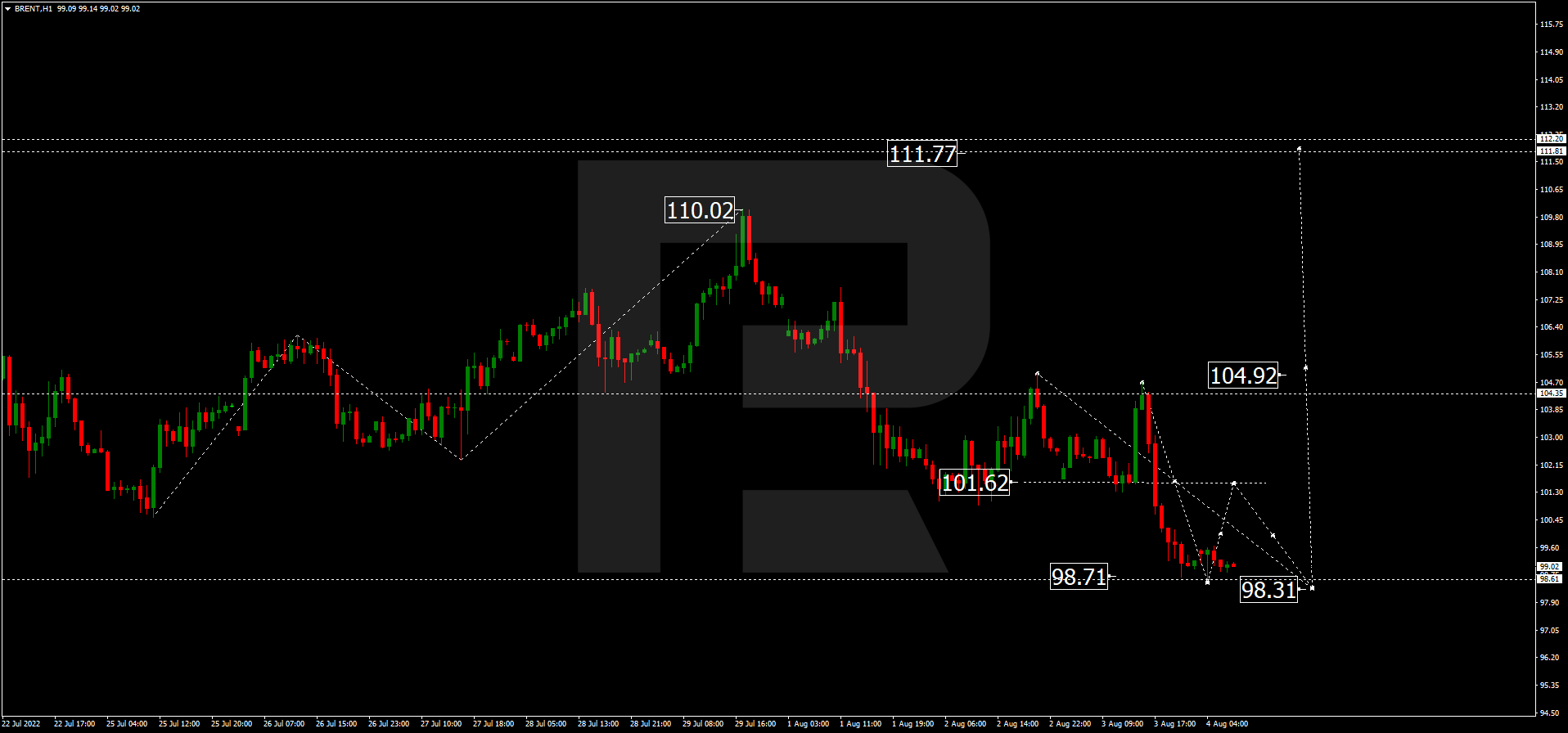

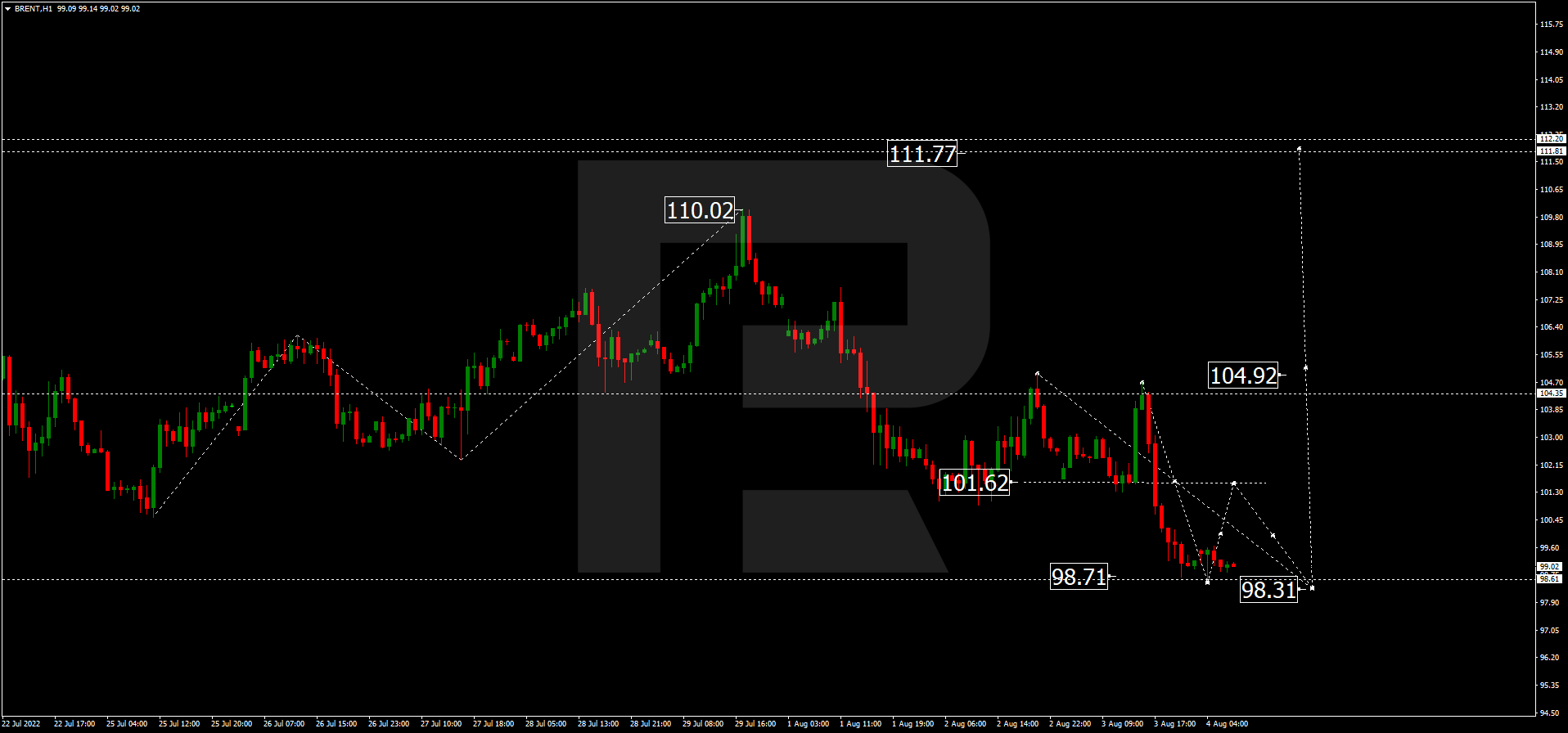

BRENT

After failing to fix above 104.90 and plunging towards the downside border of the range at 101.62, Brent has broken the latter level downwards. Possibly, the asset may continue falling to reach 98.31. Later, the market may form one more ascending wave with the target at 105.00, or even extend this structure up to 111.77.

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

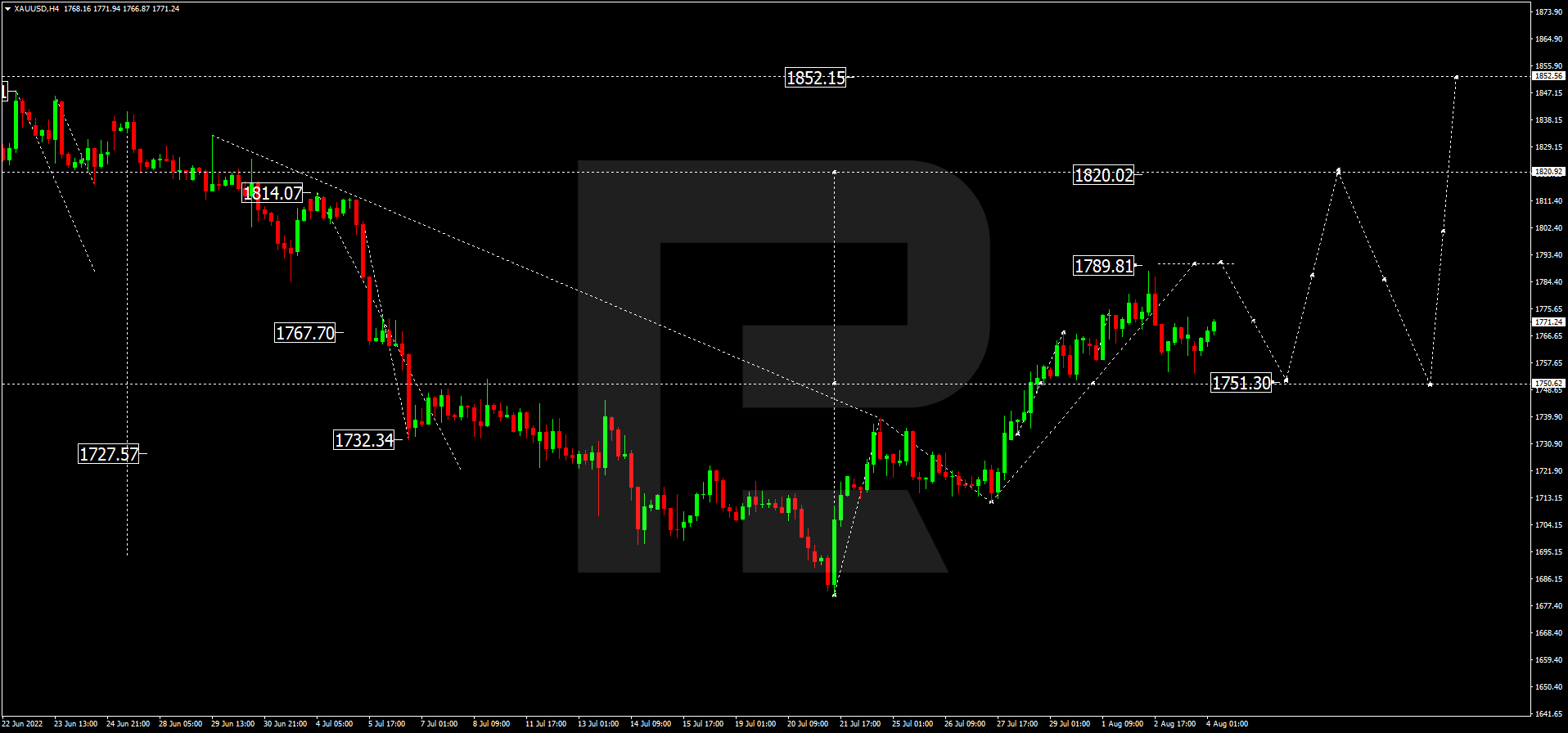

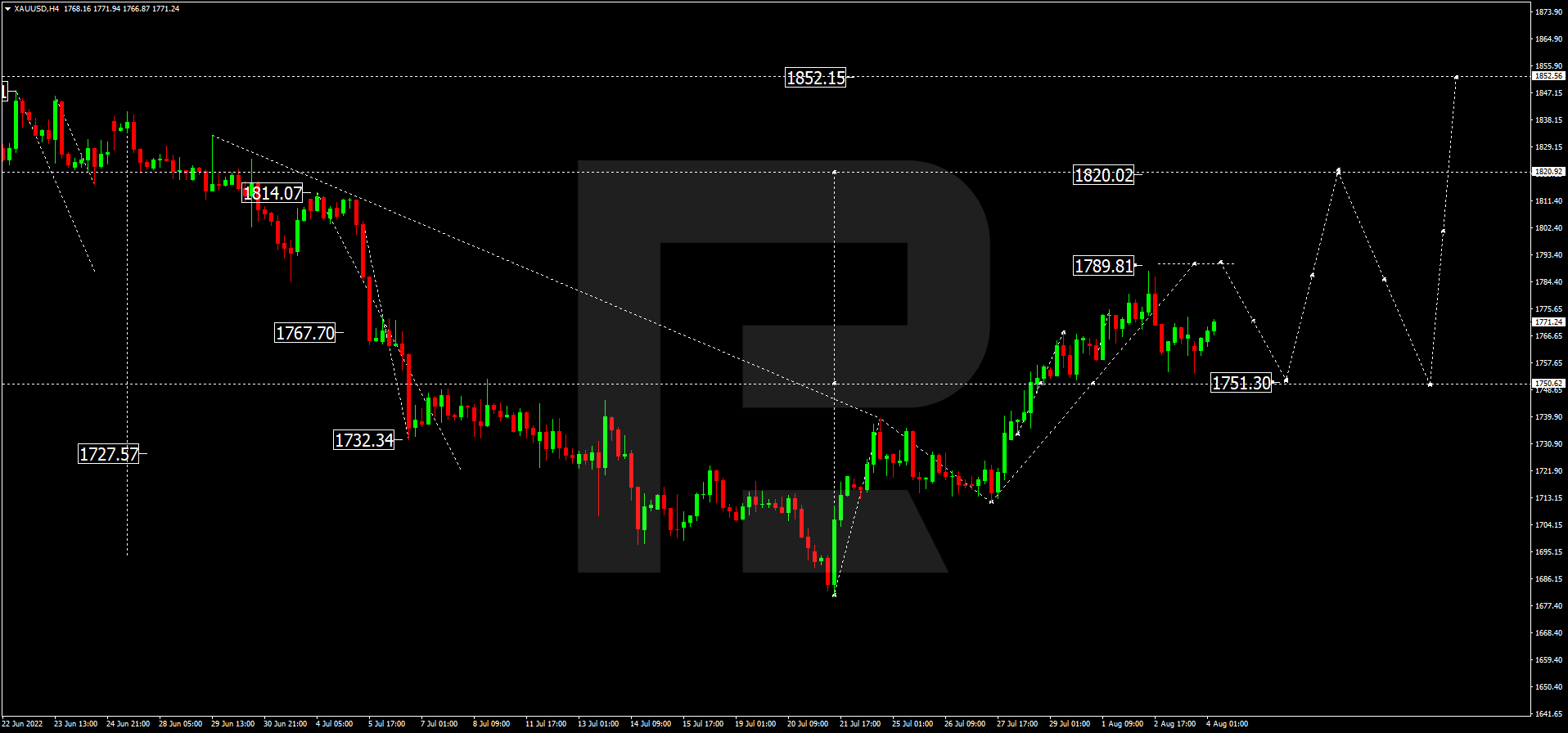

XAUUSD, “Gold vs US Dollar”

Gold continues consolidating above 1751.30. Today, the metal may grow towards 1789.81 and then fall to reach 1751.30. After that, the instrument may resume trading upwards with the target at 1820.00, or even extend this structure up to 1852.55.

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

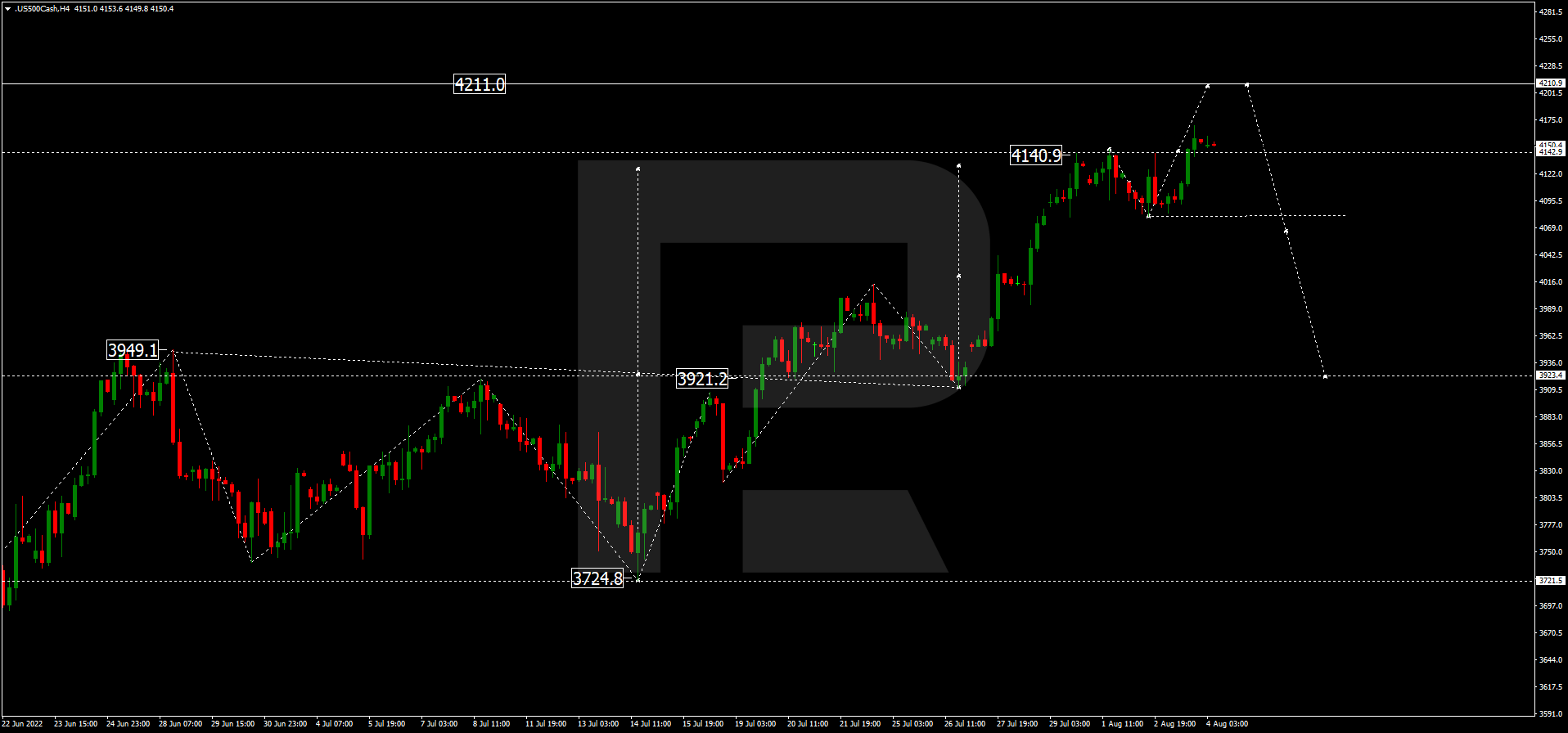

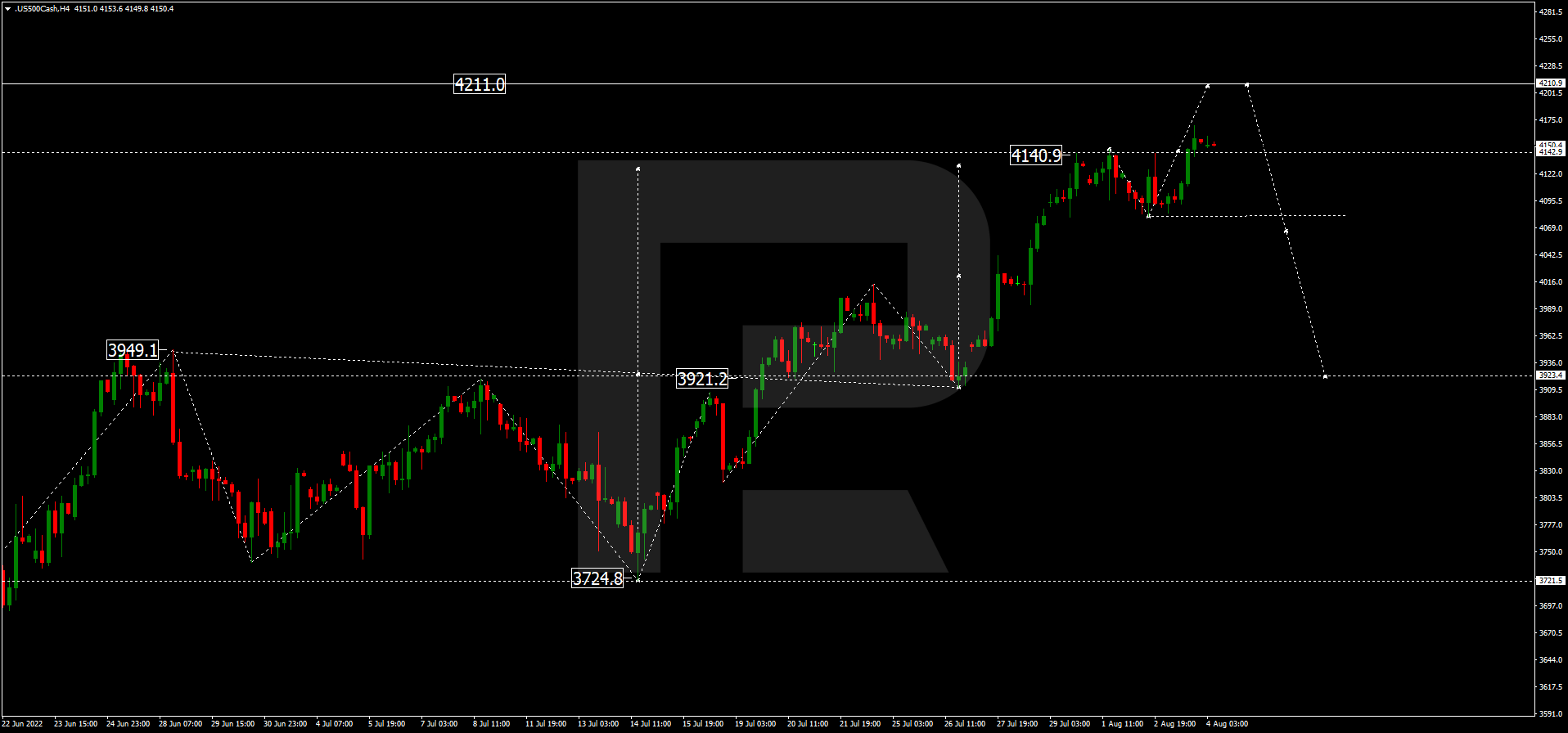

S&P 500

The S&P index is trying to break 4141.0 upwards and fix above it. If the asset succeeds, it may continue growing towards 4111.0. After that, the instrument may start a new decline to break 4100.0 and then continue trading downwards with the target at 3922.0.

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()