Analysis

Ichimoku Cloud Analysis 25.04.2023 (GBPUSD, AUDUSD, NZDUSD)

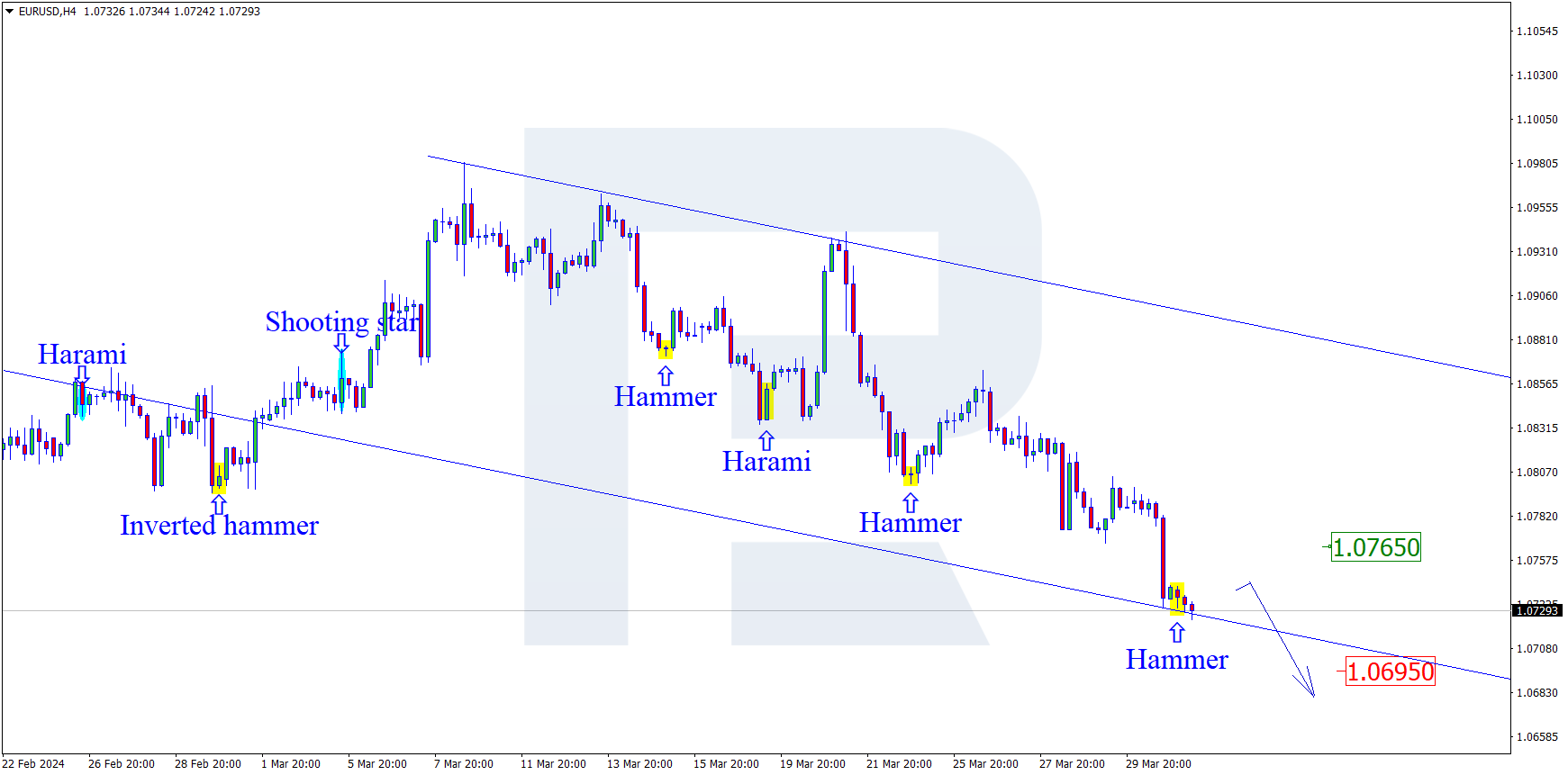

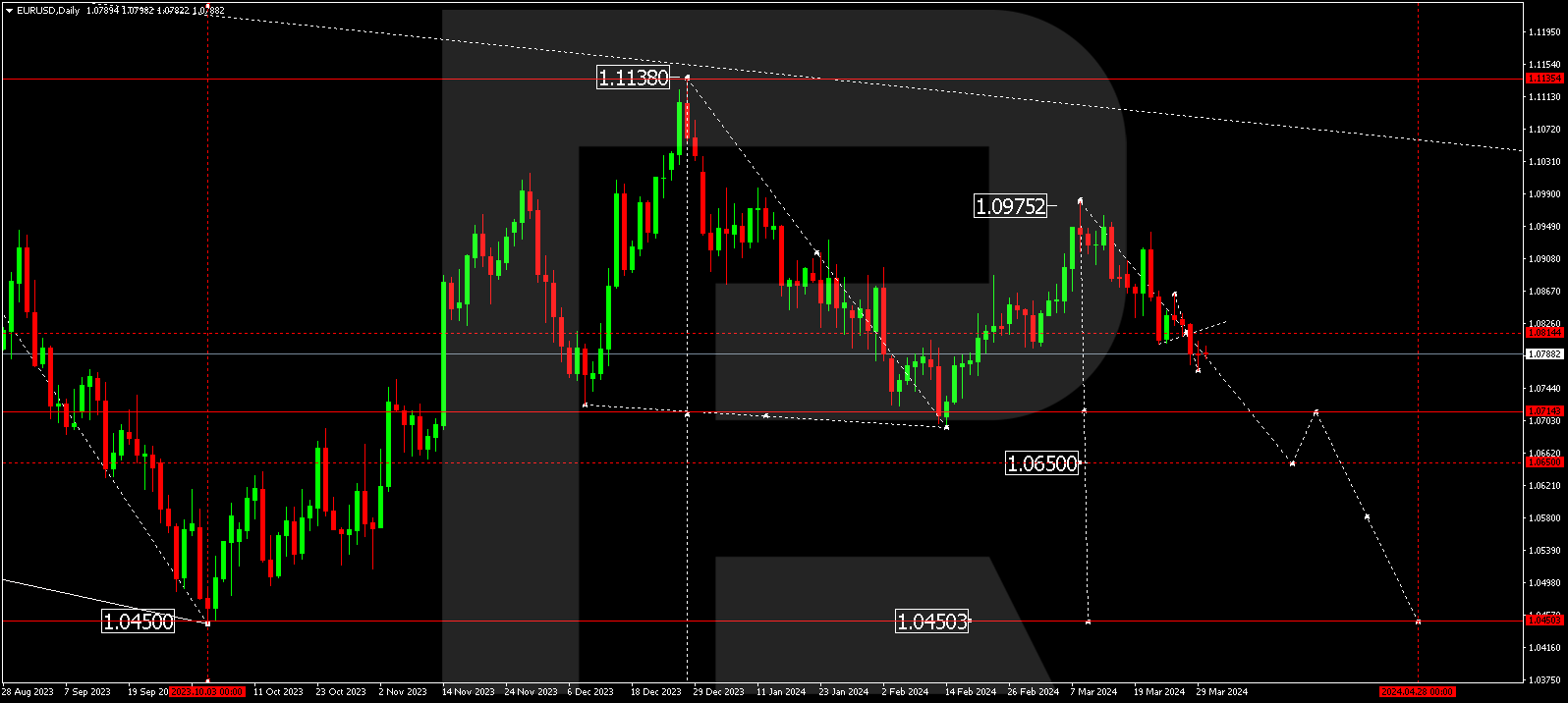

GBPUSD, “Great Britain Pound vs US Dollar”

GBPUSD is correcting in a forming Triangle pattern. The instrument is going above the Ichimoku Cloud, which suggests an uptrend. A test of the upper border of the Cloud at 1.2460 is expected, fo…

GBPUSD, “Great Britain Pound vs US Dollar”

GBPUSD is correcting in a forming Triangle pattern. The instrument is going above the Ichimoku Cloud, which suggests an uptrend. A test of the upper border of the Cloud at 1.2460 is expected, followed by growth to 1.2675. An additional signal confirming the growth will be a rebound from the lower border of the bullish channel. The scenario can be cancelled by a breakout of the lower border of the Cloud and securing under 1.2345, which will mean further falling to 1.2255. The growth, meanwhile, can be confirmed by a breakout of the upper border of the Triangle pattern and securing above 1.2535.

![]()

![]()

![]()

![]()

AUDUSD, “Australian Dollar vs US Dollar”

AUDUSD is getting ready to break through the lower border of the bullish channel. The instrument is going below the Ichimoku Cloud, which suggests a downtrend. A test of the lower border of the Cloud at 0.6705 is expected, followed by falling to 0.6565. An additional signal confirming the decline will be a rebound from the upper border of the bearish channel. The scenario can be cancelled by a breakout of the upper border of the Cloud and securing above 0.6725, which will mean further growth to 0.6815. The decline, meanwhile, can be confirmed by a breakout of the lower border of the bullish channel and securing under 0.6645.

![]()

![]()

![]()

![]()

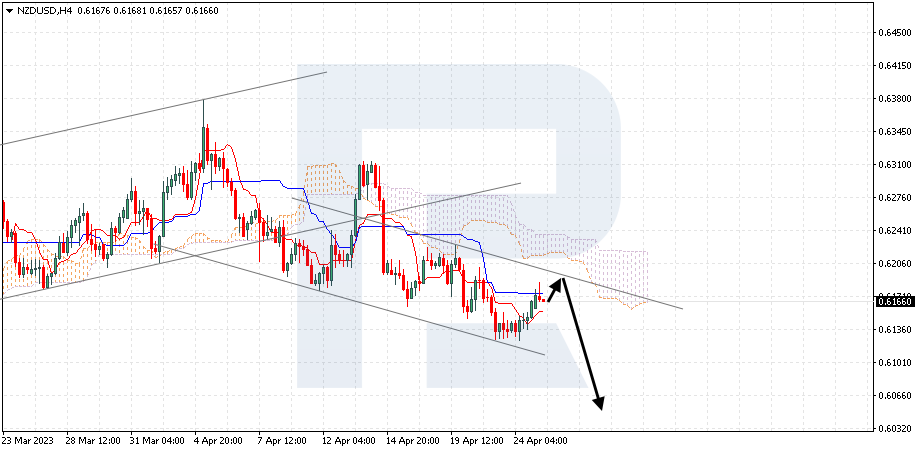

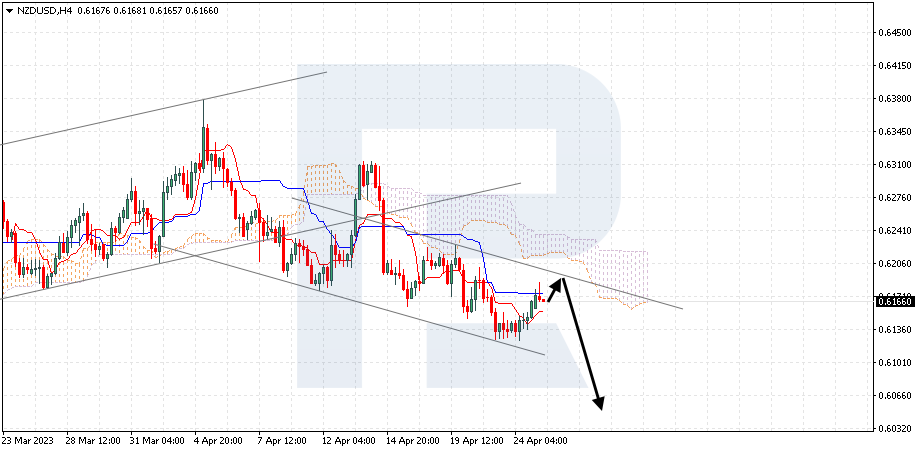

NZDUSD, “New Zealand Dollar vs US Dollar”

NZDUSD is pushing off the resistance level. The instrument is going below the Ichimoku Cloud, which suggests a downtrend. A test of the Kijun-Sen line at 0.6175 is expected, followed by falling to 0.6045. An additional signal confirming the decline will be a rebound from the upper border of the descending channel. The scenario can be cancelled by a breakout of the upper border of the Cloud and securing above 0.6255, which will mean further growth to 0.6345.

![]()

![]()

![]()

![]()