Analysis

Murrey Math Lines 20.06.2023 (AUDUSD, NZDUSD)

AUDUSD, “Australian Dollar vs US Dollar”

AUDUSD broke the level of 8/8 (0.6835) on H4 and escaped the overbought area. The RSI has broken the support line. In this situation, a test of 7/8 (0.6774) is expected, followed by a breakout of …

AUDUSD, “Australian Dollar vs US Dollar”

AUDUSD broke the level of 8/8 (0.6835) on H4 and escaped the overbought area. The RSI has broken the support line. In this situation, a test of 7/8 (0.6774) is expected, followed by a breakout of this level and a decline to the support at 6/8 (0.6713). The scenario can be cancelled by rising above the resistance at 8/8 (0.6835). In this case, the pair could continue growing and reach the level of +2/8 (0.6958).

![]()

![]()

![]()

![]()

![]()

On M15, the lower line of the VoltyChannel is broken. This increases the probability of a further price decline.

![]()

![]()

![]()

![]()

![]()

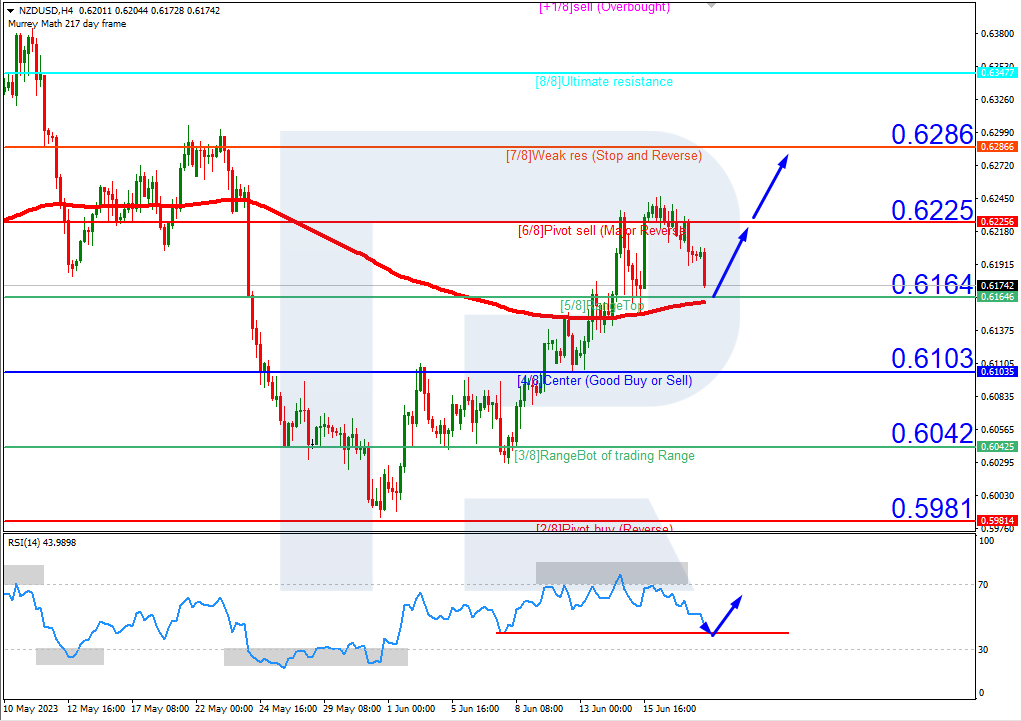

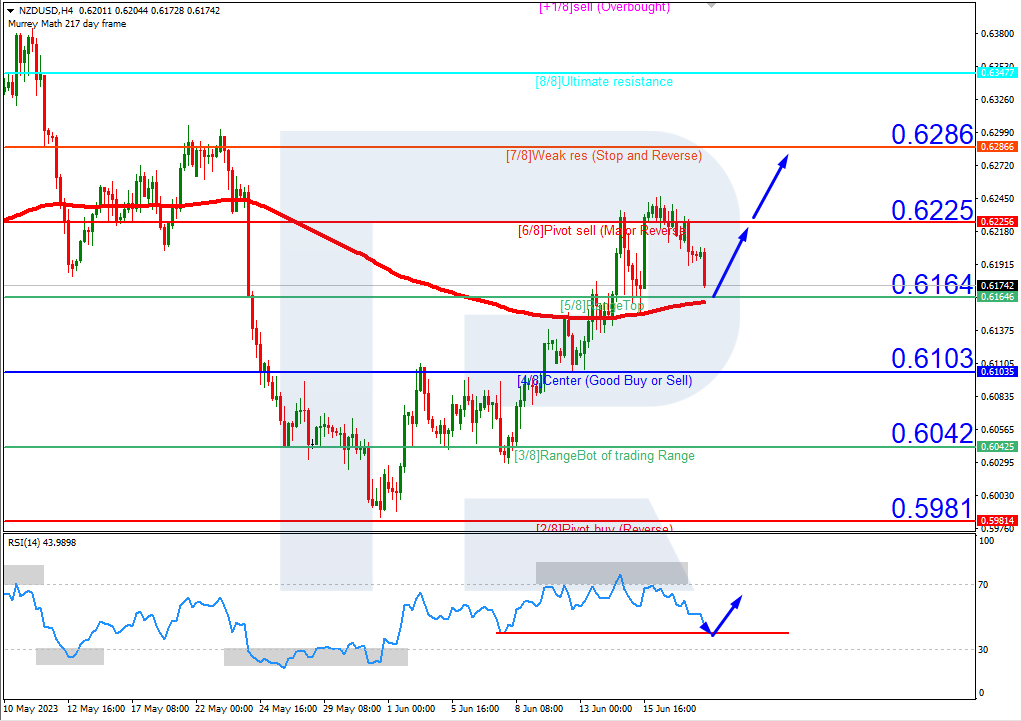

NZDUSD, “New Zealand Dollar vs US Dollar”

NZDUSD quotes are above the 200-day Moving Average on H4, indicating the prevalence of an uptrend. The RSI is nearing the support line. As a result, a test of 5/8 (0.6103) is expected, followed by a rebound from it and a rise to the resistance at 7/8 (0.6286). The scenario can be cancelled by a downward breakout of 5/8 (0.6164), which might lead to a trend reversal and a decline to the support at 3/8 (0.6103).

![]()

![]()

![]()

![]()

![]()

On M15, further price growth could be supported by a breakout of the upper line of the VoltyChannel.

![]()

![]()

![]()

![]()

![]()