Analysis

Murrey Math Lines 22.05.2023 (EURUSD, GBPUSD)

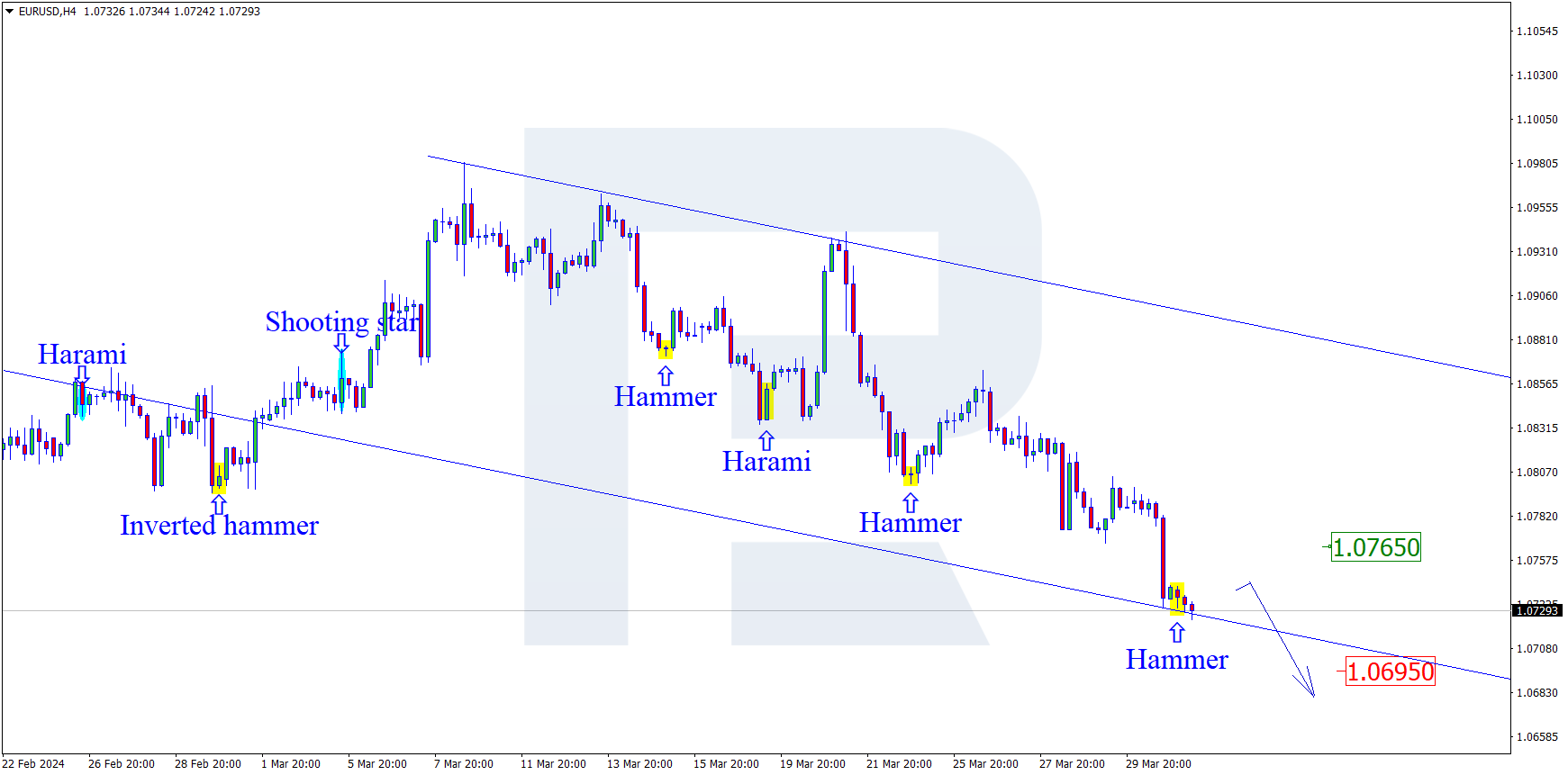

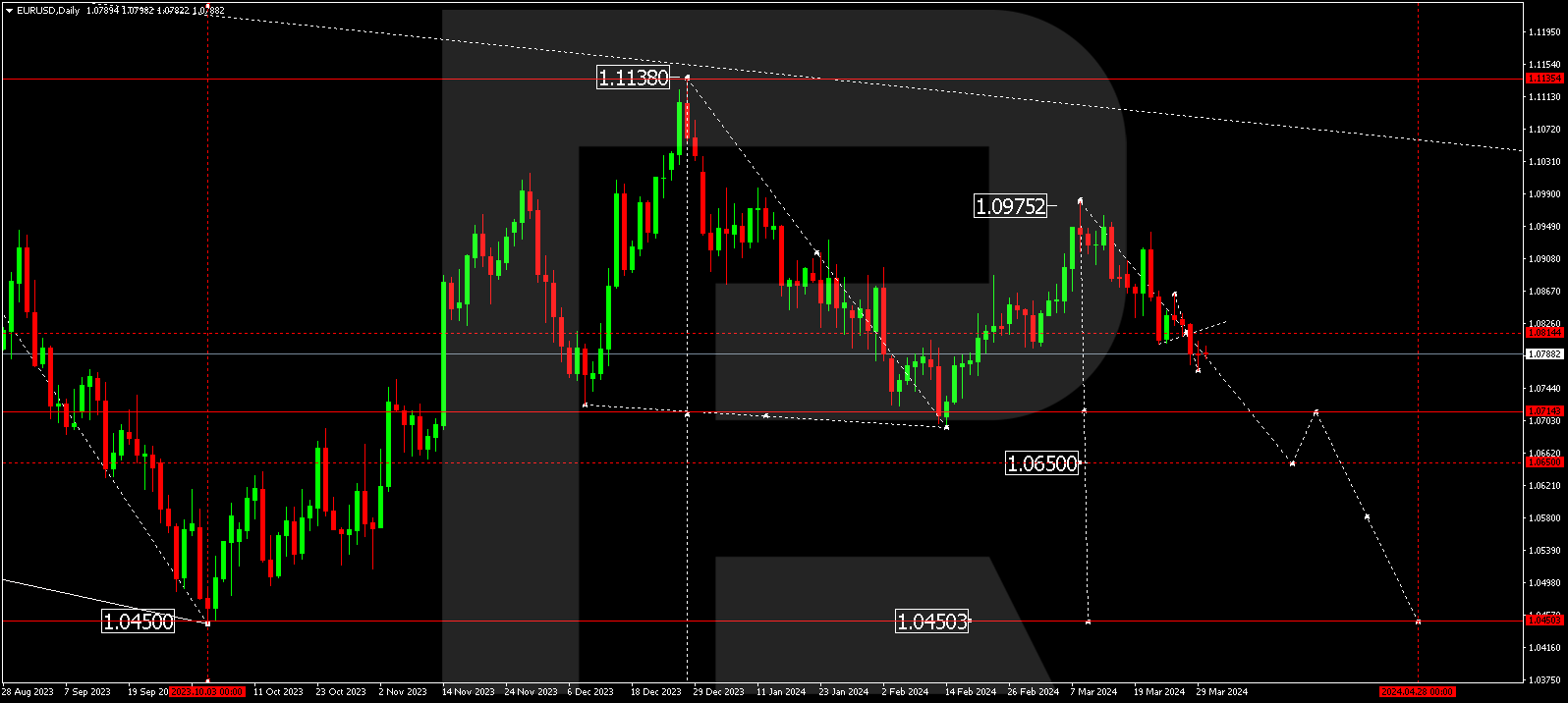

EURUSD, “Euro vs US Dollar”

On H4, the quotes are under the 200-day Moving Average, revealing the prevalence of a downtrend. The RSI is approaching the resistance line. In this situation, a downward breakout of 1/8 (1.0803) is expected, …

EURUSD, “Euro vs US Dollar”

On H4, the quotes are under the 200-day Moving Average, revealing the prevalence of a downtrend. The RSI is approaching the resistance line. In this situation, a downward breakout of 1/8 (1.0803) is expected, followed by a decline to the support at 0/8 (1.0742). The scenario can be cancelled by rising above 2/8 (1.0864). In this case, the pair could climb to the resistance at 3/8 (1.0925).

![]()

![]()

![]()

![]()

![]()

On M15, a breakout of the lower border of the VoltyChannel will serve as an additional signal for the price decline.

![]()

![]()

![]()

![]()

![]()

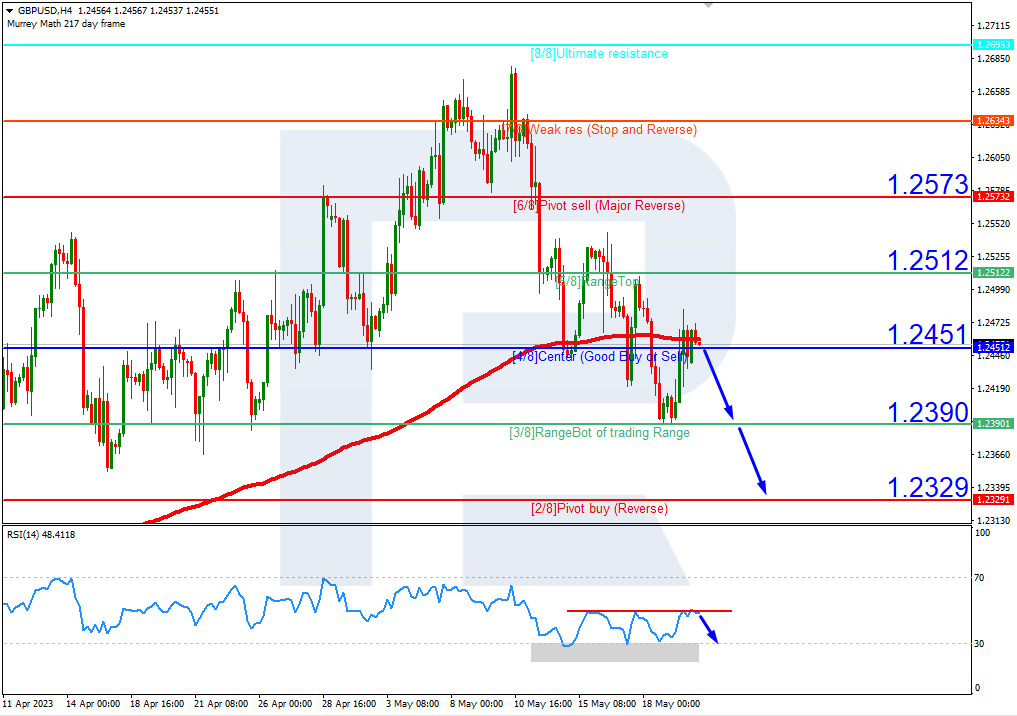

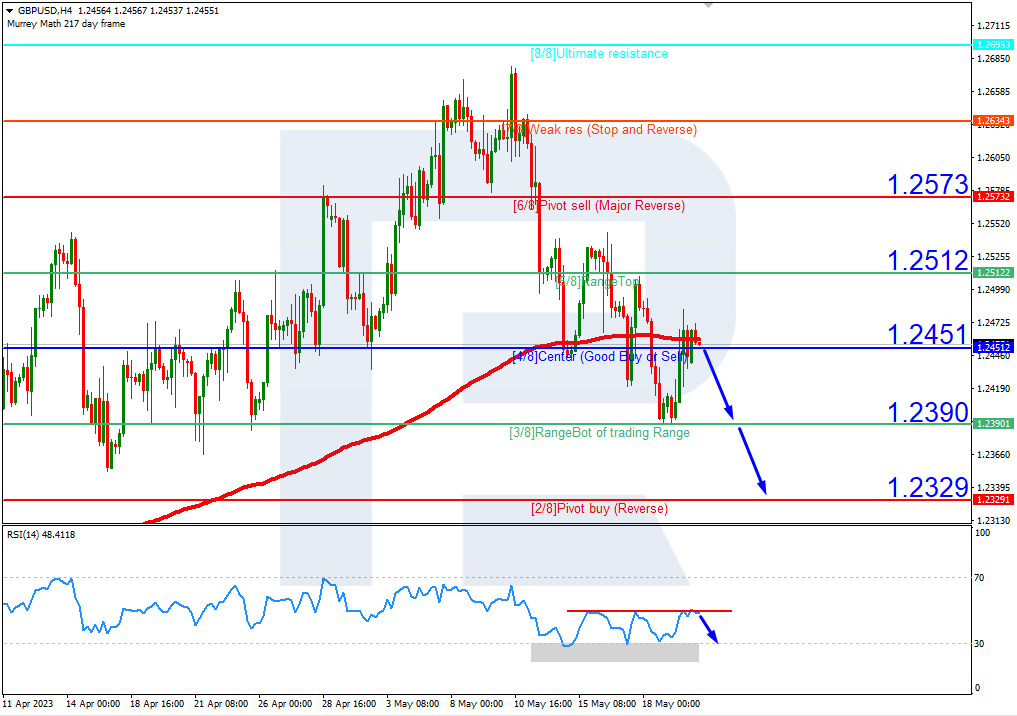

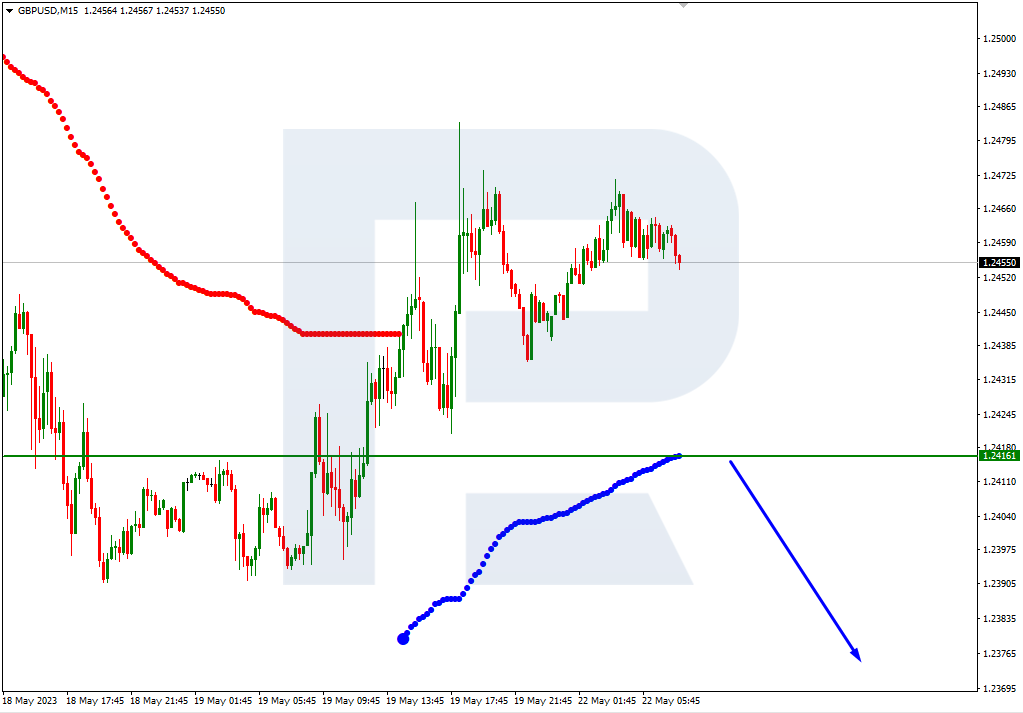

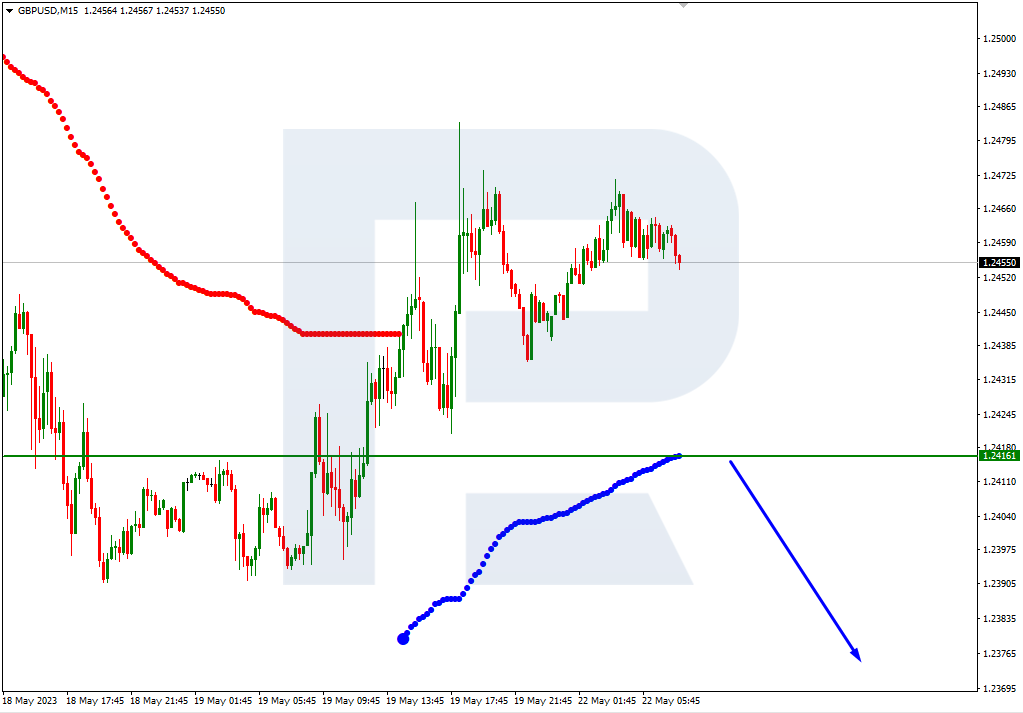

GBPUSD, “Great Britain Pound vs US Dollar”

On H4, the quotes are under the 200-day Moving Average, revealing the prevalence of a downtrend. The RSI is testing the resistance line. In this situation, a downward breakout of 4/8 (1.2451) is expected, followed by a decline to the support at 2/8 (1.2329). The scenario can be cancelled by rising above the resistance at 5/8 (1.2512), which could lead to a trend reversal and growth of the pair to 6/8 (1.2573).

![]()

![]()

![]()

![]()

![]()

On M15, a breakout of the lower border of the VoltyChannel will increase the probability of a decline to 2/8 (1.2329) on H4.

![]()

![]()

![]()

![]()

![]()