Analysis

Murrey Math Lines 24.11.2022 (USDCHF, XAUUSD)

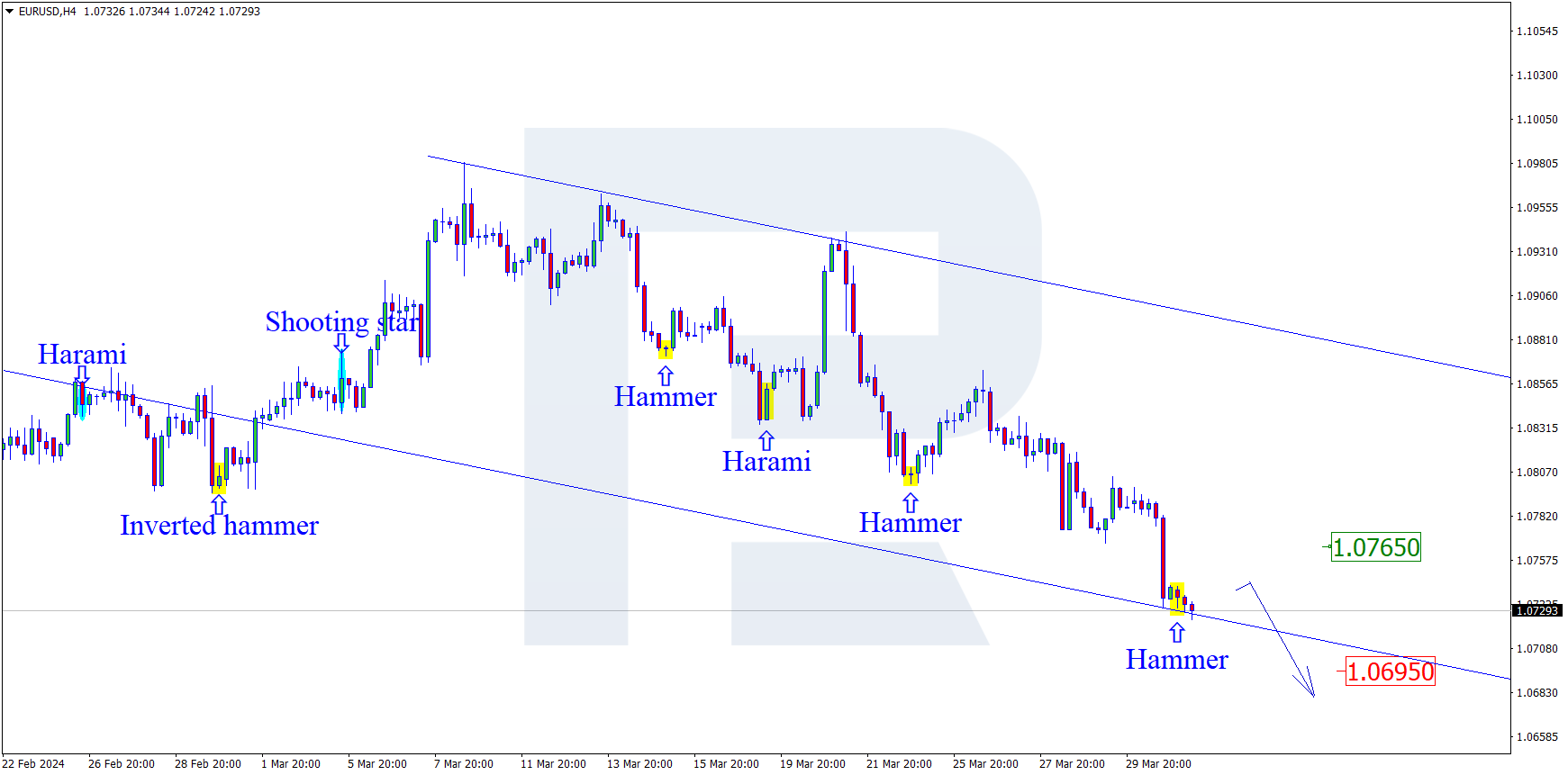

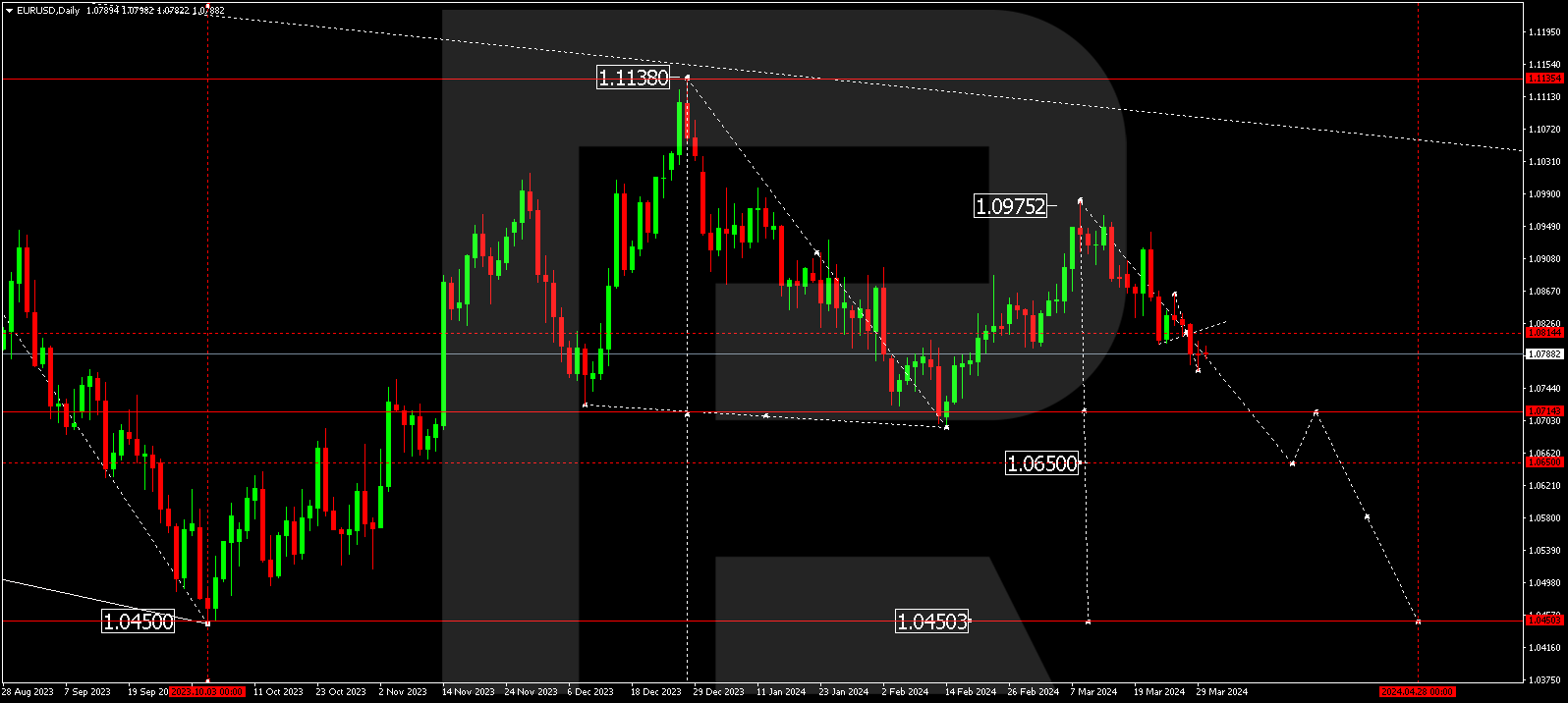

USDCHF, “US Dollar vs Swiss Franc”

On H4, the quotes are under the 200-day Moving Average, which indicates prevalence of a downtrend. However, the RSI is already in the oversold area. Here we should expect a test of the support level at …

USDCHF, “US Dollar vs Swiss Franc”

On H4, the quotes are under the 200-day Moving Average, which indicates prevalence of a downtrend. However, the RSI is already in the oversold area. Here we should expect a test of the support level at 0/8 (0.9277), a bounce off it, and growth to the resistance level of 2/8 (0.9521). The scenario can be cancelled by a downward breakaway of 0/8 (0.9277). In this case, the decline might continue, and the quotes might drop to -1/8 (0.9155).

![]()

![]()

![]()

![]()

![]()

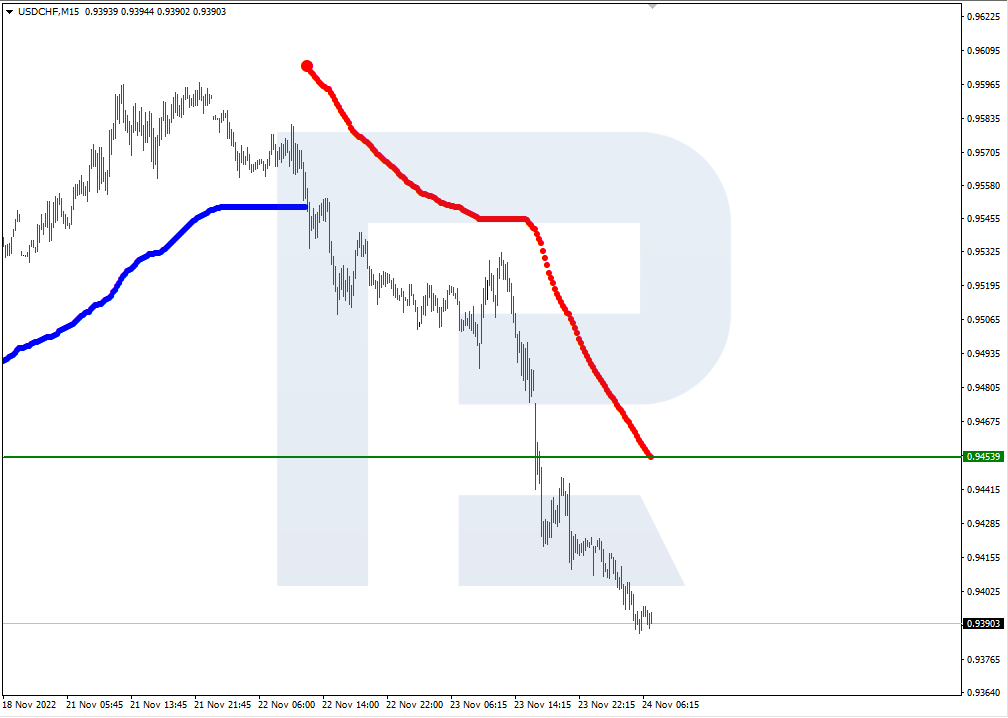

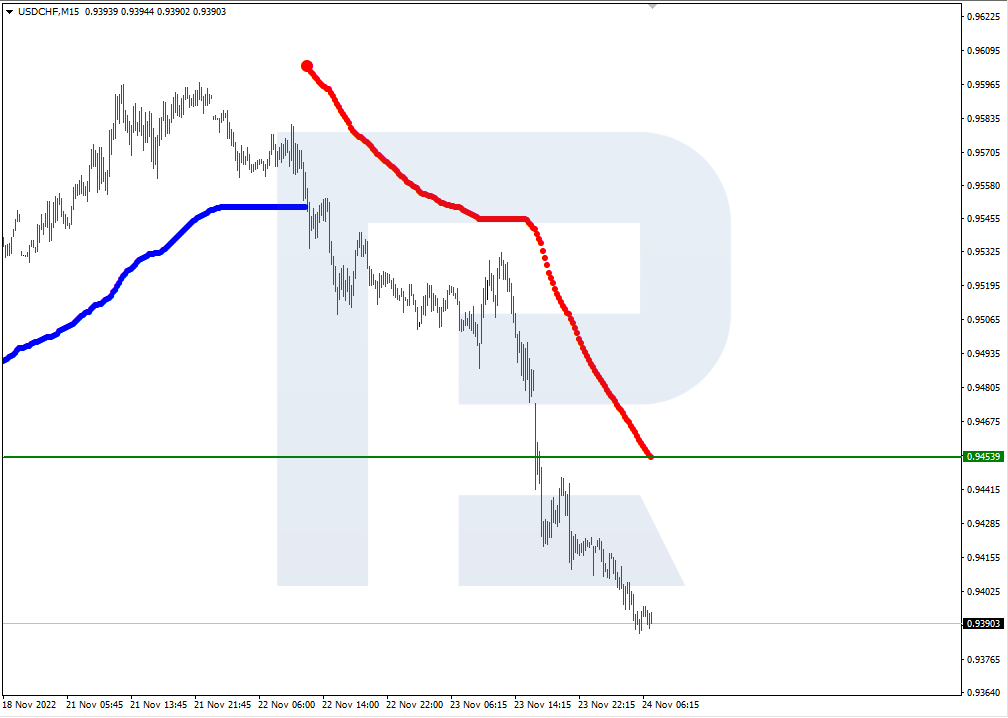

On M15, the upper line of VoltyChannel is too far away from the current price, so growth will be signaled by a bounce off 0/8 (0.9277) on H4.

![]()

![]()

![]()

![]()

![]()

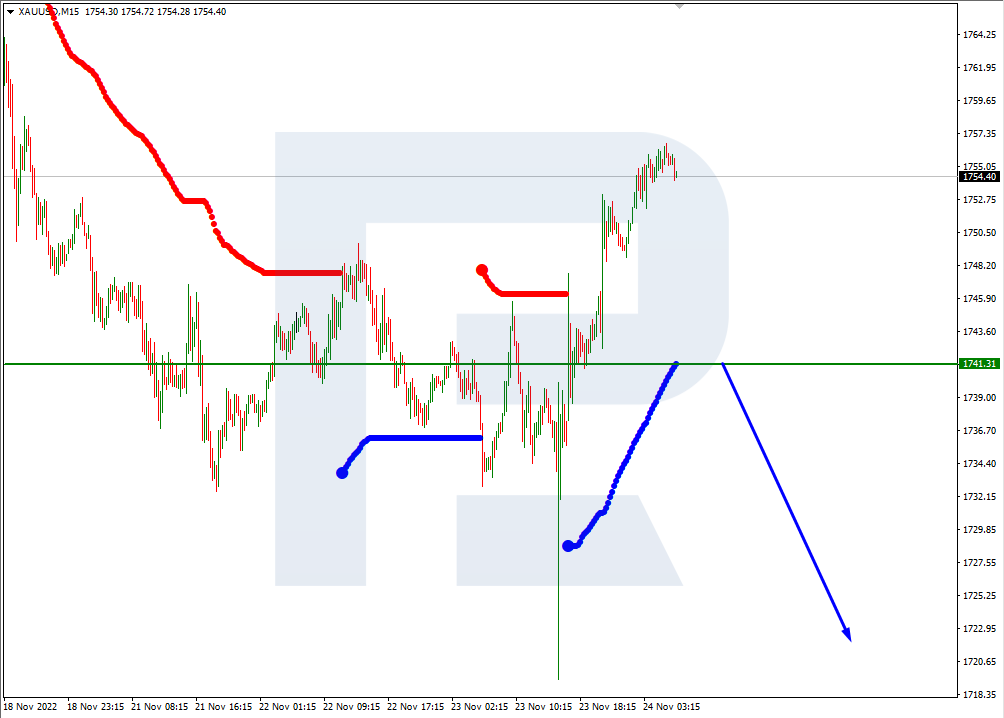

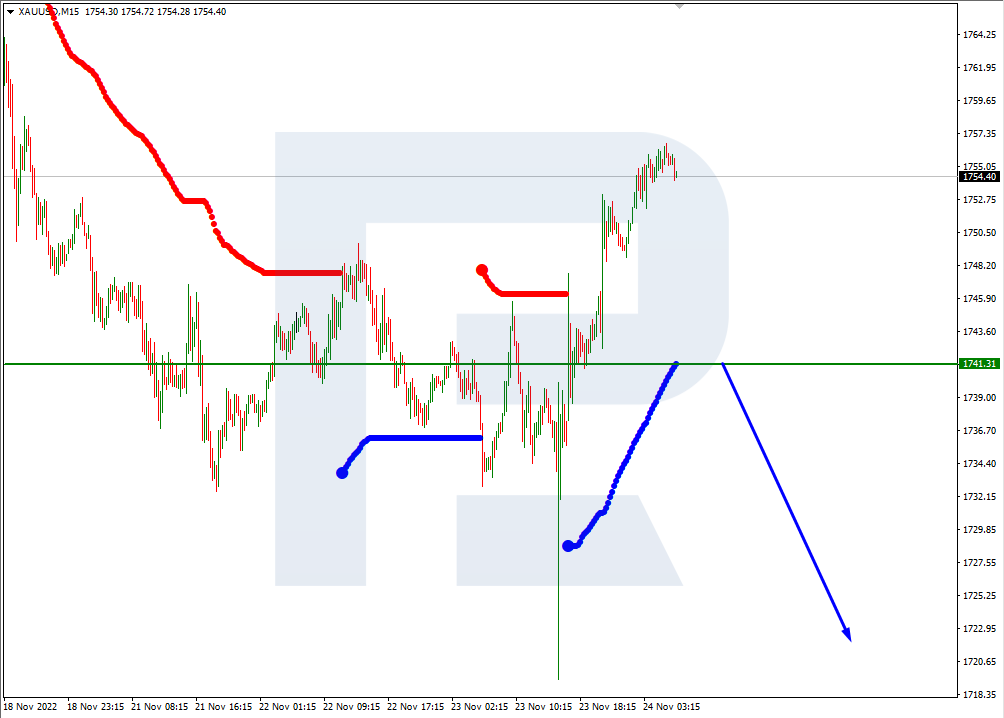

XAUUSD, “Gold vs US Dollar”

On H4, gold quotes are in the overbought area, while the RSI is testing the resistance line A downward breakaway of 8/8 (1750.00) is expected, followed by falling to the support level of 7/8 (1718.75). The scenario can be cancelled by rising over the resistance level of +1/8 (1781.25). This might entail further growth to +2/8 (1812.50).

![]()

![]()

![]()

![]()

![]()

On M15, an additional signal for a decline may be given by a breakaway of the lower border of VoltyChannel.

![]()

![]()

![]()

![]()

![]()